What is Bitcoin and Why It Matters Today

Bitcoin remains the world’s most influential cryptocurrency, shaping global finance, corporate strategies, and blockchain innovation worldwide.

Introduction: Bitcoin’s Role in Modern Finance

Bitcoin stands as both a household name in finance and a technological frontier still evolving. Sixteen years after Satoshi Nakamoto launched the first blockchain, Bitcoin continues to dominate the digital asset market, influencing everything from corporate balance sheets to global regulation. With the 2024 halving behind us, U.S. spot Bitcoin ETFs live, and new technologies like RGB protocol and Bitcoin NFTs emerging, the cryptocurrency is far more than an experiment—it’s a central pillar of modern finance.

This article takes a comprehensive look at what Bitcoin is, how it works, and why it continues to matter in the modern financial system, covering both its timeless fundamentals and its new directions.

A Brief History of Bitcoin

Bitcoin was launched in 2009 by the pseudonymous creator Satoshi Nakamoto as “peer-to-peer electronic cash.” Its original whitepaper envisioned a system that eliminated banks as middlemen, using cryptography to validate transactions.

Key milestones in Bitcoin’s journey include:

- 2008: Satoshi Nakamoto publishes the Bitcoin whitepaper.

- 2009: The genesis block (first block) is mined, marking the birth of the Bitcoin network.

- 2010: The first real-world purchase is made when 10,000 BTC buys two pizzas.

- 2013–2017: Bitcoin exchanges like Coinbase and Kraken grow rapidly, while regulators begin discussing cryptocurrency policy. In 2017 Bitcoin undergoes a major fork, creating Bitcoin Cash amid debates on scaling.

- 2020: First major companies and institutional investors add Bitcoin to their balance sheets, sparking mainstream adoption.

- 2021: Bitcoin reaches an all-time high (ATH) of $69,000 and a market cap above $1 trillion during the bull market. That same year, El Salvador becomes the first country to adopt Bitcoin as legal tender.

- 2024: The U.S. approves spot Bitcoin ETFs, and Bitcoin surges to $100,000.

- 2025: The U.S. government establishes a strategic Bitcoin reserve, signaling Bitcoin’s role in national policy.

Today, Bitcoin is valued at around $2 trillion in market capitalization, making it more valuable than most global companies.

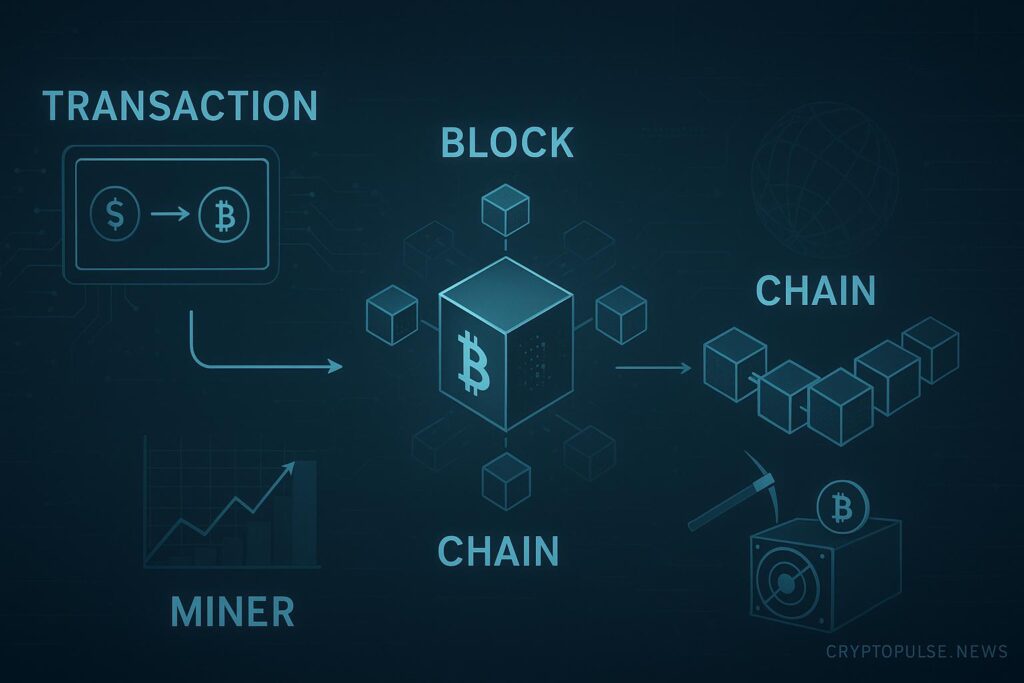

How Bitcoin Works (The Basics Made Simple)

At its core, Bitcoin is a global public ledger — like a shared notebook that exists on thousands of computers at once. This ledger is called the blockchain, and it records every transaction that has ever happened in Bitcoin’s history. What makes it powerful is that no single company or government owns it; instead, everyone can see and verify it.

Here’s how a simple transaction works:

When Alice sends 0.1 BTC to Bob, the following steps happen automatically:

- The transaction request is broadcast to the Bitcoin network.

- Nodes (computers running Bitcoin software) check it — confirming Alice has enough Bitcoin and isn’t trying to spend the same coins twice.

- The transaction joins a waiting room (a pool of unconfirmed payments).

- Miners pick up the transaction and group it with others into a block. To secure the block, miners compete to solve a mathematical puzzle (this is the proof-of-work mechanism).

- The winning miner adds the block to the blockchain. Once it’s added, the transaction becomes part of Bitcoin’s permanent history — transparent and unchangeable.

- The miner is rewarded with new Bitcoin plus the transaction fees. This reward system ensures miners keep the network running.

This cycle repeats roughly every 10 minutes, creating a new block and extending the chain.

The brilliance of Bitcoin lies in its design:

- Mathematics makes it secure.

- Transparency allows anyone to verify it.

- Incentives motivate miners to maintain it.

And perhaps the most important feature: Bitcoin’s supply is permanently capped at 21 million coins. This fixed limit, unlike the endless money-printing of traditional currencies, is what gives Bitcoin its reputation as “digital gold” and makes it attractive to long-term investors and institutions.

Why Bitcoin Still Matters

Store of Value

Bitcoin is often called “digital gold” because of its scarcity and resistance to debasement. In times of inflation and currency devaluation, many investors turn to Bitcoin as a hedge against fiat money risks.

Financial Freedom

Bitcoin empowers individuals to self-custody wealth without banks. In regions with unstable economies or strict capital controls, it offers financial inclusion and censorship resistance — money that can’t be frozen or inflated away.

Global Relevance

From Nigeria to Argentina, Bitcoin plays a vital role in remittances and everyday payments, giving people an alternative to failing or unstable local currencies.

Corporate Treasuries

A growing number of companies now treat Bitcoin as a strategic reserve asset. Michael Saylor’s Strategy leads the chart, holding over 700,000 BTC (more than 3% of total Bitcoin supply) and continues to accumulate. Other firms — from Tesla and Coinbase to MARA Holdings — are part of the corporate treasury race.

Institutional Adoption

The approval of spot Bitcoin ETFs in the U.S. was a historic milestone. It opened Bitcoin investing to pension funds, wealth managers, and retail investors who prefer regulated markets. Financial giants like BlackRock and Fidelity now offer direct Bitcoin exposure, cementing Bitcoin’s place in mainstream finance.

Together, its limited supply, decentralization, and security make Bitcoin fundamentally different from any other form of money — and a force that continues to shape global finance.

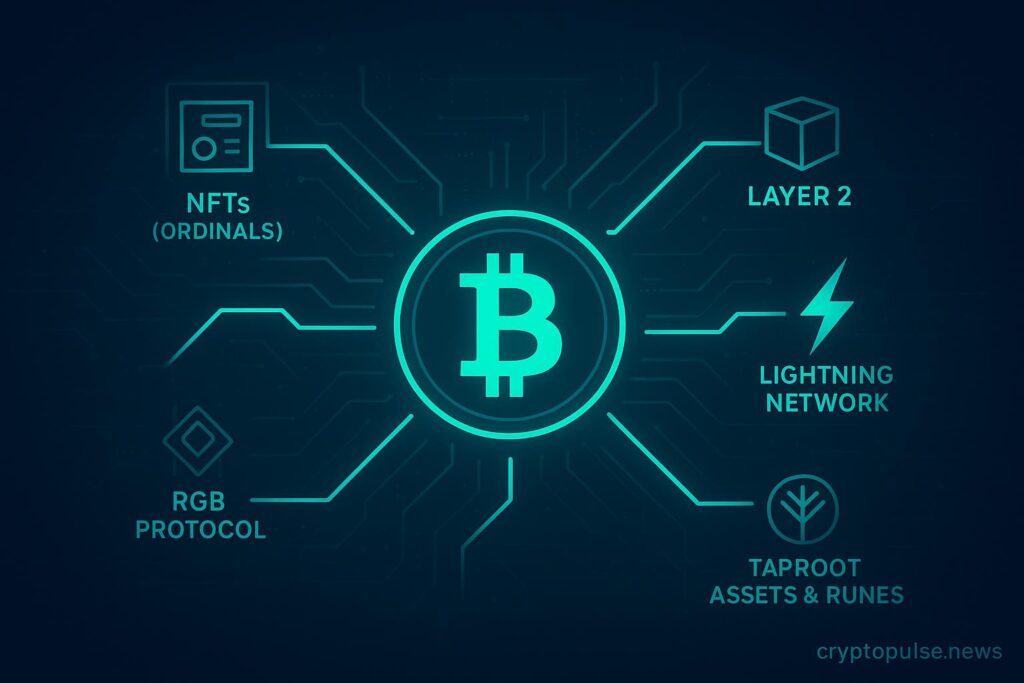

New Innovations Expanding Bitcoin’s Role

Bitcoin isn’t just “digital money” anymore — it’s evolving into a platform for new types of assets and applications. Here are some of the most notable innovations shaping Bitcoin’s ecosystem today:

Bitcoin NFTs (Ordinals)

The Ordinals protocol allows unique digital assets (NFTs) to be inscribed directly onto satoshis (the smallest Bitcoin units). This has unlocked art, collectibles, and even experimental applications — all secured by Bitcoin’s blockchain.

Layer 2 Scaling & Lightning Network

Bitcoin’s base chain processes transactions slowly by design (about one block every 10 minutes). To scale payments, Layer 2 networks like Lightning enable instant, nearly free transfers. This makes Bitcoin practical for everyday spending, from coffee shops to cross-border remittances.

Taproot Assets & Runes

The Taproot upgrade of Bitcoin paved the way for new asset standards:

- Taproot Assets allow issuing stablecoins or tokens on Bitcoin with efficiency and privacy.

- Runes protocol (a new standard launched in 2024/2025) improves fungible token issuance, competing with Ethereum-style tokens but secured by Bitcoin.

RGB Protocol & Stablecoins on Bitcoin

The RGB protocol introduces smart contracts and private asset issuance anchored to Bitcoin. A landmark move in 2025 was Tether’s launch of USDT on RGB, proving that Bitcoin can host stablecoins natively — a shift that could reshape global payments.

Why it matters: These innovations show Bitcoin is no longer a “static” network. It’s becoming a foundation for digital assets, scalable payments, and decentralized applications — without compromising its core principles of security and decentralization.

Bitcoin in Everyday Life

Bitcoin isn’t just for traders and corporations — it’s also quietly shaping daily financial interactions around the world.

- Payments & Remittances: In regions with weak banking systems or high remittance fees, Bitcoin is becoming a lifeline. Migrant workers can send money home instantly, often saving their families 10–15% in fees compared to traditional services.

- Microtransactions: Thanks to scaling solutions, Bitcoin now enables tiny, real-time payments — from tipping creators online to pay-per-article journalism. These use cases were impractical before but are becoming more common.

- Merchants & Retailers: Major companies like PayPal, Microsoft, and a growing number of global e-commerce platforms allow Bitcoin payments. Even small businesses in countries like El Salvador or Nigeria accept Bitcoin, treating it as both a currency and a hedge against inflation.

- Financial Access: For millions without access to banks, Bitcoin wallets provide a gateway to digital finance, requiring only a smartphone and internet connection.

The big picture: Bitcoin is no longer just a speculative asset — it’s increasingly woven into the way people save, spend, and move money.

Challenges and Criticisms

Despite its success, Bitcoin still faces serious challenges:

- Energy Consumption: Bitcoin mining requires massive electricity, leading to debates about sustainability. While miners increasingly use renewable energy, critics argue the network is still energy-intensive.

- Scalability: Even with Lightning and Layer 2, Bitcoin’s base layer is limited in speed and throughput compared to other blockchains.

- Regulatory Uncertainty: Countries disagree on whether Bitcoin is a currency, commodity, or security. The creation of a U.S. Strategic Bitcoin Reserve under Trump in 2025 highlights rising institutional and governmental acceptance, but future regulation remains unpredictable worldwide.

- Volatility: Prices can still swing dramatically. For individuals and companies, this creates risk when using Bitcoin for savings or payments.

Bottom line: Bitcoin’s innovations are expanding its use cases, but its long-term dominance will depend on how it balances adoption, regulation, and environmental pressures.

The Future of Bitcoin

Looking forward, Bitcoin faces multiple possible paths:

- Deeper Financial Integration: Wider ETF adoption, inclusion in retirement funds, and integration into central bank reserves.

- Technological Expansion: Growth of RGB, Taproot Assets, and Layer 2 solutions could transform Bitcoin into a broader financial platform.

- Geopolitical Role: Nations with currency crises may adopt Bitcoin as a reserve or legal tender.

- Cultural Influence: Bitcoin NFTs and tokenized assets may bring new generations of users.

Regardless of its exact trajectory, Bitcoin’s core principles of scarcity, decentralization, and security make it likely to remain at the heart of the digital economy.

Conclusion: Why Bitcoin Still Matters

Bitcoin began as a radical experiment in 2009. Today, it has grown into a trillion-dollar asset class, a corporate treasury tool, and a catalyst for innovation across global finance and technology. While challenges remain — including volatility, regulation, and scalability — its influence on the future of money is undeniable.

Nowadays, Bitcoin is no longer just a cryptocurrency. It is a global financial movement, a store of value, and a new layer of the digital economy that continues to evolve and expand.