Polkadot (DOT) Rises 5%, Can it Break Resistance?

DOT, the native token of the leading Layer-0 blockchain, Polkadot, has seen a 5% spike in its value in the past seven days. This follows an extended period of decline that caused the coin to trade at multi-month lows.

As DOT witnesses an uptick in demand, its price attempts to break above the upper of its descending channel, which has formed a resistance level since June 7.

Polkadot Aims For a Price Level Above Resistance

Polkadot has trended within a descending channel since June 7. A descending channel is a bearish signal. When an asset’s price trends within this channel, it consistently moves lower, creating a series of lower highs and lower lows.

The upper line of the channel forms resistance, which in DOT’s case has been $7.28. The lower line represents support, set at $4.77 for DOT.

At press time, the altcoin trades at $6.12, falling 7% since June 7. DOT’s price has risen by 5% in the last week and is poised to cross above the upper line of this channel—readings from its Chaikin Money Flow (CMF) hint at this possibility.

Read More: What Is Polkadot (DOT)?

This indicator measures the flow of money into and out of an asset. As of this writing, DOT’s CMF is in an uptrend. When an asset’s CMF rises, it suggests that buying pressure is dominant.

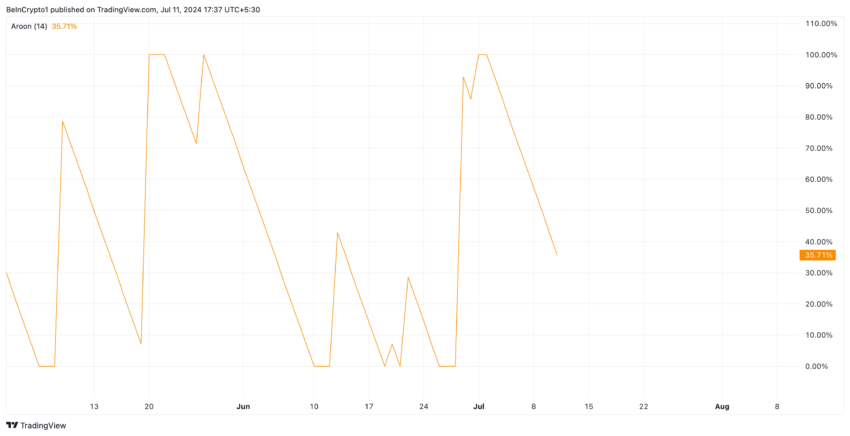

However, DOT’s falling Aroon Up Line suggests that the uptrend might not be strong enough to cause a price break above resistance.

An asset’s Aroon indicator measures its trend strength and identifies potential price reversal points. When the Up Line is close to zero, the uptrend is weak, and the most recent high was reached a long time ago.

DOT’s Aroon Up Line is in a downtrend at 35.71% at press time.

DOT Price Prediction: The Coin Has Two Options

If the uptrend grows weaker, the current price rally will halt, reversing DOT’s most recent gains. Should this happen, the coin’s price will fall below the $6 price level to trade at $5.95.

However, if demand continues to surge, the altcoin will maintain its current trend and rise to $6.27.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.