Solana On Brink Of Registering Fresh All-Time Highs In Key Metrics: Will SOL Follow?

Solana has had an impressive year. After worrying dips in late 2022, the bounce of the second half 2023 thrusted the platform to the top five.

At spot rates, not only is SOL, the native token up 100% over the last 10 months, but the network is now a meme coin hub. Solana is the third largest smart contracts platform after Ethereum and the BNB Chain.

Looking at how fast SOL has expanded over the years, there is a high possibility that the coin could be undervalued. Multiple factors support this outlook. Taking to X, one analyst notes that Solana is approaching or has already broken above levels of metrics the community closely monitors.

Solana Exploding: Revenue, TVL Soaring

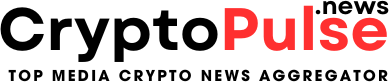

Citing Artemis data, the analyst said Solana is approaching the $12.5 million revenue level fast. Solana’s revenue has been steadily increasing over the past few weeks and for the better part of October.

Like in all public ledgers, revenue is derived from gas fees. The more active the blockchain, the more fees users pay to transfer tokens or deploy smart contracts. Notably, revenue, according to Artemis data, has been steadily rising since late 2022, stabilizing in H1 2023 before exploding in September 2023.

Beyond revenue, Solana also posts steady growth in total value locked (TVL). Simply put, TVL is the assets all its on-chain protocols manage. Its TVL has been picking up steam since late September and is currently above $6 billion. However, it is still less than the $10 billion registered in October 2021.

So far, DeFiLlama data reveals that Solana DeFi protocols manage $6.2 billion. The largest is Jito, a liquid staking platform controlling over $2.4 billion. On the other hand, one of the largest DEXes, Raydium, manages over $1.4 billion of assets, up 28% over the last month.

Meme Coin Activity Spikes, Will SOL Breach $200?

With rising TVL and revenue, the network has seen impressive volume spikes, reflecting on-chain engagement, mostly from protocols like Raydium. Engagement is directly driven by meme coin activity, which soared after the activation of Pump.fun in January 2024.

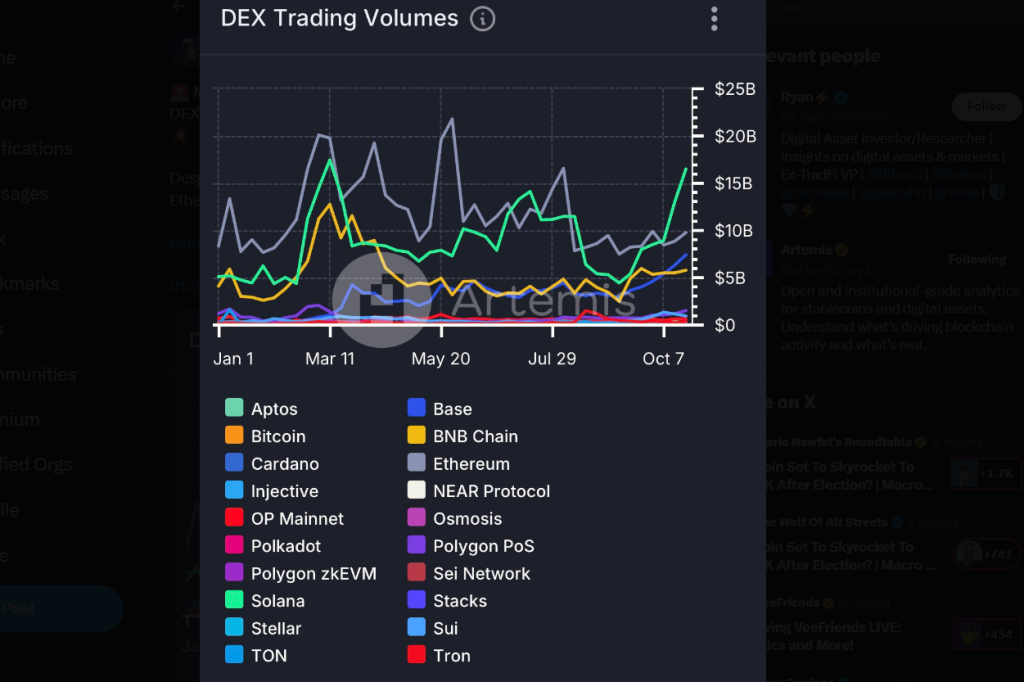

On October 27, one analyst observed that Solana had overtaken all blockchains, including Aptos, Injective, and Cardano, in weekly DEX trading volume. With over $15 billion in DEX trading volume over seven days, it represented a 150% increase over Ethereum.

Presently, SOL is changing hands at around $180. It is down from $240, the 2024 high, and $260, registered in 2021. Only time will tell whether the coin will break above the $200 round number, soaring to print new 2024 highs in the next two months.

Feature image from Adobe Stock, chart from TradingView