How to Analyze Crypto Projects Before Investing

Before putting money into any cryptocurrency project, you need a clear process to separate innovation from hype, and potential opportunities from costly scams.

Introduction

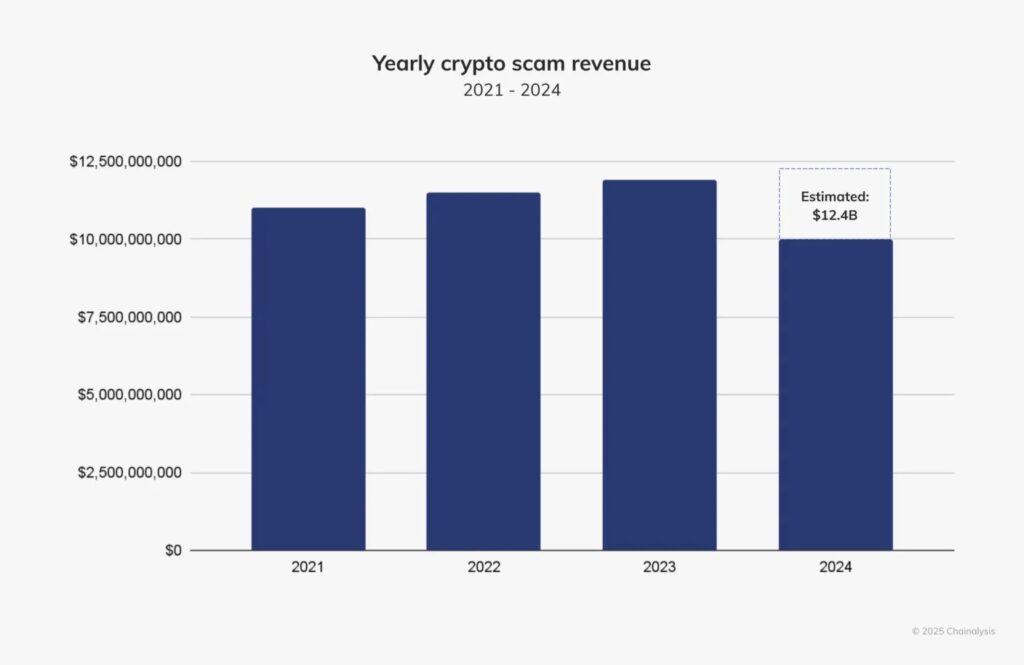

In today’s fast-moving crypto landscape, thousands of new tokens and projects launch every year. Some promise groundbreaking technology, others claim to revolutionize finance, gaming, or Web3 communities. Yet behind the excitement lies a harsh reality: scams, rug pulls, and fraudulent schemes remain widespread. Chainalysis reported that crypto scams generated at least $9.9 billion in 2024, with losses potentially exceeding $12.4 billion when accounting for pig-butchering and emerging AI-driven frauds. Meanwhile, memecoin rug pulls alone accounted for over $500 million in investor losses.

If you’re a beginner, these numbers highlight why analyzing crypto projects before investing isn’t optional — it’s essential. Our guide will give you a step-by-step framework to evaluate projects, spot red flags early, and approach investments with confidence.

Beware Scams and Rug Pulls: The Market Reality

Before diving into fundamentals, let’s set the stage with what’s happening in the market today.

- Scams at record highs: 2024 was one of the worst years on record, with Chainalysis noting that scam revenue hit nearly $12.4 billion, fueled by more sophisticated frauds.

- Rug pulls dominate DeFi crime: Rug pull and Ponzi scheme losses in 2024 reached $4.6 billion, with rug pulls making up about 65% of DeFi scams.

- Memecoin mania turned ugly: According to CoinDesk, investors lost over $500 million to memecoin rug pulls in 2024, proving that hype-driven communities often mask high risks.

- AI-powered deception: Reports from Reuters highlighted that generative AI tools were used to produce fake audits, websites, and even impersonations of known developers, making scams harder to spot.

- Victims pay the price: The average loss per victim of a DeFi rug pull was around $9,800 in 2024.

Note for Beginners: A rug pull happens when crypto developers suddenly abandon a project and run away with investors’ funds. This usually occurs in decentralized finance (DeFi) projects or meme tokens where liquidity is drained from trading pools, leaving holders with worthless tokens. Always verify audits, liquidity locks, and team credibility to reduce this risk.

The takeaway: scams are evolving, not disappearing. As a beginner, you must learn how to identify projects worth your attention and filter out those designed only to drain your wallet.

If you’re just entering the market and haven’t made your first purchase yet, check our guide on how to buy your first cryptocurrency, which explains safe ways to start.

Understanding the Basics and Value Proposition

Every credible project starts with a clear mission. When evaluating a new crypto asset, ask:

- What problem does it solve? Legitimate projects address a real gap in the market, whether scaling, privacy, interoperability, or decentralized finance.

- Is the whitepaper transparent and realistic? A good whitepaper explains technology, tokenomics, and roadmap in detail. Watch for vague promises or excessive jargon.

- Roadmap and milestones: Are goals achievable and measurable, or overly ambitious with no timeline?

- Token utility: Does the token have a functional use case (e.g., governance, staking, payments), or is it just speculative?

A classic example is Bitcoin, which solved the double-spending problem and created the foundation of decentralized money — check more in our guide what is Bitcoin.

Team, Governance, and Transparency

The team behind a project often determines its credibility.

- Founders and developers: Are they public or anonymous? Transparency adds trust. Research their professional history on LinkedIn, GitHub, or Crunchbase.

- Track record: Have they built successful projects before?

- Advisors and investors: Well-known advisors or reputable venture firms can be a positive signal, though always verify.

- Governance model: How are decisions made? Centralized decision-making with full control by a small group is riskier than decentralized structures.

Red flag example: Projects with entirely anonymous teams, no external validation, and no clear governance process are highly prone to exit scams.

Technology, Code, and Security

Crypto projects live and die by their technology.

- Smart contract audits: Has the code been audited by reputable firms (e.g., CertiK, Hacken)? Public reports should be available.

- Open source development: Check GitHub activity. Are there regular updates, or was the repo abandoned months ago?

- Security red flags: Watch for contracts that are upgradeable by a single wallet, lack time-locks, or allow unlimited minting.

- Bug bounty programs: Projects offering rewards for vulnerability discoveries show commitment to security.

Tokenomics and Financial Risk Factors

Tokenomics reveals whether a project is sustainable or a potential rug pull.

Key elements to check:

- Total vs. circulating supply: A token with 1% in circulation and 99% locked with insiders is risky.

- Distribution: Who owns the tokens? If a few wallets hold the majority, manipulation risk is high.

- Liquidity and lockups: Is liquidity locked in a smart contract? If not, developers can drain pools.

- Emission schedule: Are tokens released gradually, or dumped on the market quickly?

- Rewards and APYs: Promises of “1000% APY” are unsustainable — a red flag.

For comparison, explore our curated list of top altcoins to watch, which highlights projects with stronger fundamentals and token models.

Community, Marketing, and Social Signals

A project’s community can be a strong indicator of legitimacy:

- Engagement quality: Are discussions meaningful, or just memes and hype?

- Moderation: Does the team address tough questions or delete them?

- Follower growth: Sudden spikes in Telegram or Twitter followers can signal fake bots.

- Tone of marketing: Projects promising “guaranteed returns” are likely scams.

Red flag example: A project’s Telegram chat is flooded with bot-generated messages about every small transaction, repetitive memes, excessive hashtags, and sticker spam encouraging users to “buy now.”

Green flag example: In contrast, a healthy community chat often includes thoughtful questions from investors, transparent answers from the team, and discussions about the project’s long-term vision rather than just short-term price hype.

External Validation and Third-Party Signals

Partnerships and independent recognition add credibility. Look for:

- Audits published by well-known firms

- Exchange listings: Is the project listed on regulated or tier-1 exchanges?

- Partnerships: Are collaborations with other projects or companies real? Fake partnerships are common. Always cross-check.

- Media coverage: Coverage in major outlets (CoinDesk, CoinTelegraph) is more credible than sponsored posts on obscure blogs.

Tools and Resources for Doing Due Diligence

Beginners don’t need to start from scratch. Here are a few tools/resources you can use:

- Blockchain explorers (Etherscan, BscScan) to track contract addresses and holders.

- Token analysis tools (Token Sniffer, Dextools) for liquidity and ownership stats.

- Audit reports from CertiK, Hacken, PeckShield.

- Community checkers like Reddit r/CryptoCurrency, where red flags are often flagged quickly.

- Price aggregators (CoinGecko, CoinMarketCap) for liquidity and supply breakdowns.

Risk Management and Investment Strategy

Even after thorough due diligence, investing in crypto carries risk. Always remember these best practices:

- Never invest more than you can afford to lose.

- Diversify across multiple projects and asset classes.

- Phased entry: Invest small amounts first, increasing only if milestones are met.

- Secure storage: Always move assets off exchanges to hardware wallets for long-term security.

Once you decide to invest, storing your crypto properly is crucial — our guide on how to store cryptocurrency securely covers best practices.

Conclusion

The crypto market offers enormous opportunity, but it’s also a breeding ground for scams. By understanding red flags, analyzing fundamentals, and applying structured due diligence, you dramatically reduce your risk of falling victim to rug pulls or fraudulent projects.

Remember: due diligence isn’t a one-time step — it’s an ongoing process as projects evolve. Keep learning, stay cautious, and protect your capital while exploring the future of digital assets.

Explore more from CryptoPulseNews:

- How to Use ChatGPT for Crypto Trading & Investing

- How To Get Crypto for Free

- 5 Essential Tips When the Crypto Market Crashes

FAQ – Analyzing Crypto Projects

The first step is to read the project’s whitepaper to understand its goals, use cases, and roadmap. If the whitepaper is vague or poorly written, that’s a red flag.

Look for transparent information about the founders and developers. Legit teams often share LinkedIn profiles, previous projects, and verifiable professional backgrounds. Anonymous teams aren’t always scams, but they require extra caution.

Not necessarily, but projects that lack independent security audits pose higher risks. For beginners, it’s safer to stick to tokens with at least one reputable audit.

Watch out for locked liquidity status, token distribution patterns, and whether the community chat is focused only on “buy now” hype. If the team controls most of the supply, that’s a danger sign.

Bitcoin and Ethereum are the safest starting points because of their long history, high liquidity, and strong communities. Beginners can learn with these before branching into riskier altcoins.