Federal Income Taxes in Bitcoin: Gaetz’s Proposal

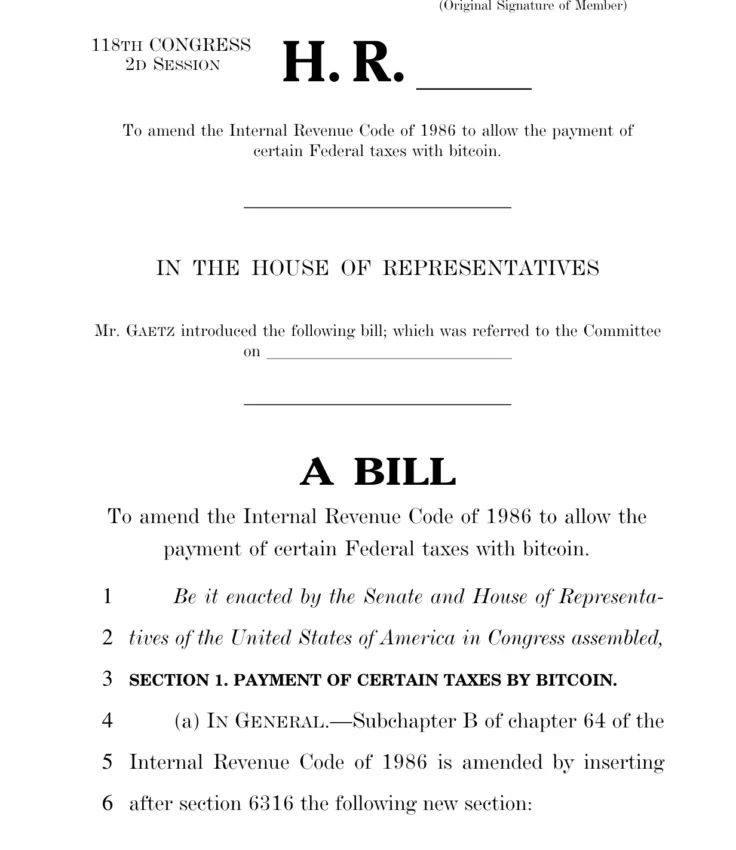

US Congressman Matt Gaetz has proposed a bill to make federal income tax payable using Bitcoin.

The bill’s passing will be a significant development for crypto adoption, but it will also have ramifications for Bitcoin investors.

Matt Gaetz Proposes Bitcoin for Federal Income Taxes

Florida Rep. Matt Gaetz wants the Internal Revenue Code of 1986 amended so that Federal income tax becomes payable in Bitcoin. The bill calls for the Treasury to allow any tax imposed on a taxpayer to be paid with BTC.

In his argument, Gaetz sees this as a means to promoting innovation, increasing efficiency, and offering more flexibility to American citizens.

“[Treasury to] develop and implement a method to allow for the payment with Bitcoin of any tax imposed on an individual,” read an excerpt of the proposed bill.

South Carolina Representative Nancy Mace supports the bill, inclining it to advance her own proposal on property ownership.

“Okay hear us out: Use your Bitcoin to pay taxes with Rep Matt Gaetz’s bill, and take out a mortgage with our crypto bill,” wrote Mace.

If it passes, it would mark a significant stride in crypto adoption in the US. Indeed, it would not only mean a massive change in the current US Treasury code but also bear serious implications for Bitcoin investors. The government would need to cash in on these holdings every time it needs to settle its expenses, causing supply shocks.

To put it in perspective, the total amount of Federal income tax paid by US taxpayers in 2023 was approximately $1.7 trillion. Assuming only a small percentage of these individuals, say 1%, would pay their taxes in Bitcoin, it would translate to around $18 billion in Bitcoin given to the government.

However, introducing Bitcoin payments for taxes would require clear regulatory guidelines and legal frameworks to ensure compliance and prevent potential misuse of the system. Uncertainty or regulatory changes related to tax payments in Bitcoin could also affect market sentiment and BTC price.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.