Ethereum’s Average Staker Revenue Drops Sharply As Network Activity Declines

The Ethereum network, one of the leading blockchain solutions has once again taken a hit as the network’s average staker revenue over the past few days has witnessed a sharp decline, indicating a decrease in users’ or stakers’ interest and engagement.

Ethereum’s Stakers Face Dimishied Returns

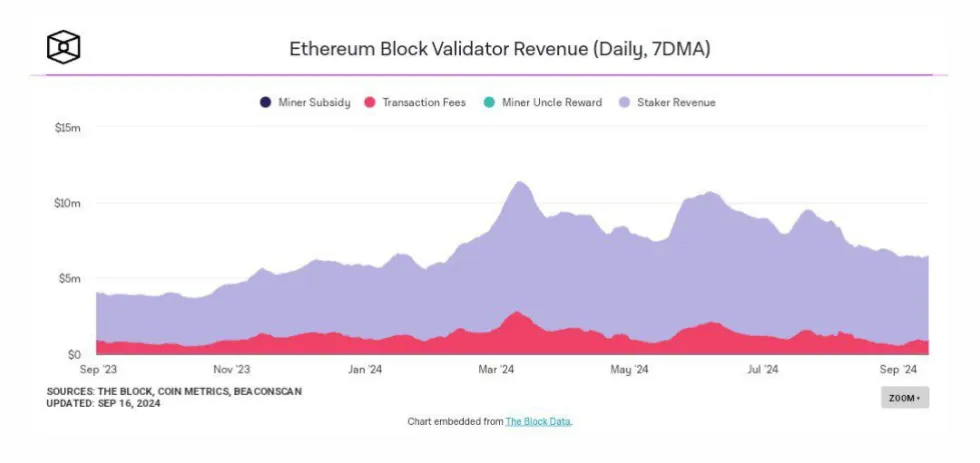

In a negative development, the average revenue of Ethereum’s stakes has dropped dramatically, reaching fresh lows as the network activity is experiencing a major slowdown. Ethereum‘s proof-of-stake mechanism participants have seen lower rewards as a result of decreased demand and fewer transactions on the network, which has significantly impacted staking returns.

Kyle Doops, a well-known market expert and host of the Crypto Banter show shared the negative development on the X (formerly Twitter) platform. The staking yields have declined due to a combination of factors such as lower transaction volume, which coincides with a larger drop in the market.

According to the expert, Ethereum’s average staker revenue for the last 7 days fell sharply to a 6-month low. Specifically, on September 12, the revenue was recorded at about $5.44 million.

He noted that transaction fees also experienced a decline due to a drop in network activity, which severely impacted staker earnings. Furthermore, the transaction volume and on-chain activity plummeted, falling precipitously from March peaks and reflecting February 2024 levels.

The average staker revenue is one of many metrics that has fallen significantly in the past few days. Ethereum’s futures market funding rates have also experienced a decrease to new lows.

Kyle Doops revealed that the futures market is currently hitting rock-bottom funding rates in 2024, indicating a persistent bearish trend. As funding rates plummet to new levels, traders appear to be taking extra caution, demonstrating a widening gap between long and short positions in the market.

With the 50-day average funding rate showing a consistent bearish trend, buying interest seems to be shrinking. Until perpetual futures or spot markets see a surge in demand, Kyle Doops is confident that the price of ETH might remain low.

Do Recent Movements Suggest ETH Is Gearing Up For Gains?

Despite these negative developments, Ethereum’s price is slowly attracting gains as revealed by CoinMarketCap. At the time of writing, ETH stands at $2,326, reflecting an increase of about 0.61% in the past 24 hours. However, this price level was recovered after ETH witnessed a strong resistance at the $2,388 level yesterday sending prices downward to $2,300.

While ETH in the past day has been gradually increasing, the weekly and monthly timeframe shows that the crypto asset has declined by over 0.50% and 11.14% respectively. ETH’s market cap and trading volume in the past have increased by 0.60% and 14%, which indicates that investors are betting on the digital asset’s renewed momentum.

Featured image from Unsplash, chart from Tradingview.com