Crypto Investments Hit $4.3 Billion Amid Interest In Bitcoin ETFs

Cryptocurrency investments continue to record growing capital inflows, ascribed to Bitcoin spot ETF (exchange-traded funds) approvals in January.

Bitcoin recorded up to $1.97 billion in inflows last week, followed by Ethereum at $69 million in positive flows.

Crypto Investments Hit $2 Billion Last Week

Cryptocurrency investment inflows have accumulated to $4.3 billion in five weeks. The last week saw positive flows of $2 billion, with BTC leading at $1.97 billion, followed by ETH at $69 million.

“Ethereum also experienced a BIG week, with $69 million in inflows, its highest since March,” said BTC veteran Kyle Chassé in a Monday post on X.

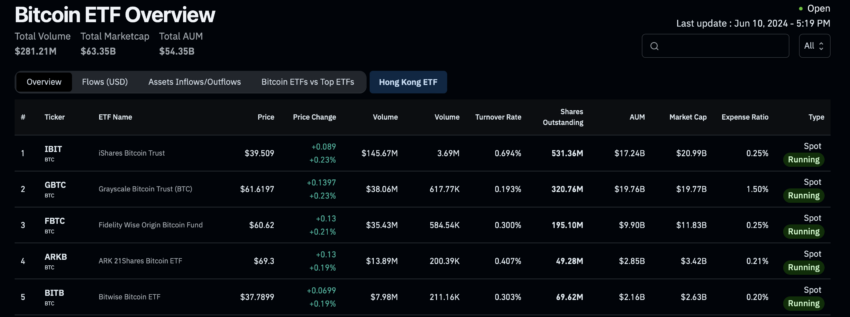

Bitcoin has seen 19 consecutive days of inflows, driven by increasing interest from institutional and retail traders. Currently, ETFs hold 5% of all Bitcoin, with 34 ETFs controlling over 1,000,000 BTC. Last week, 11 ETFs approved by the US Securities and Exchange Commission (SEC) purchased 25,729 BTC. This amount is nearly eight times more than the 3,150 BTC mined during the same period.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Bitcoin ETFs in the US now hold almost 5% of all BTC. According to Coinglass, spot funds overall hold 1,043,775 BTC as of Monday. Currently, 19.71 million BTC are in circulation, valued at $1.36 trillion at the current Bitcoin price, with an eventual limit of 21 million BTC expected to be reached over the next century.

Even as investors seek exposure to BTC through ETFs, Bitcoin price has been unable to reclaim its all-time high of $73,777 recorded on March 14. Experts attribute this to massive shorting among hedge funds.

“Why is Bitcoin price suppressed while ETFs are stacking like crazy? Because hedge funds are shorting BTC at record highs,” prominent trader Quinten indicated.

Hedge funds have historically shorted BTC as part of a trading strategy where they sell futures contracts to profit from anticipated price drops. Sina G, co-founder of BTC-focused 21st Capital, noted that hedge funds taking short positions on BTC might signal their interest in the carry trade strategy. This involves shorting futures while simultaneously buying the asset to exploit price differences between the spot and futures markets.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

In a typical scenario, a short squeeze would occur. This happens when Bitcoin prices begin to rise, forcing those with short positions to buy back BTC at higher prices to cover their positions. This increased buying pressure further drives up Bitcoin’s price, causing more short sellers to exit their positions and adding to the upward price momentum.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.