Crypto Inflows Hit $585 Million In First Week of 2025

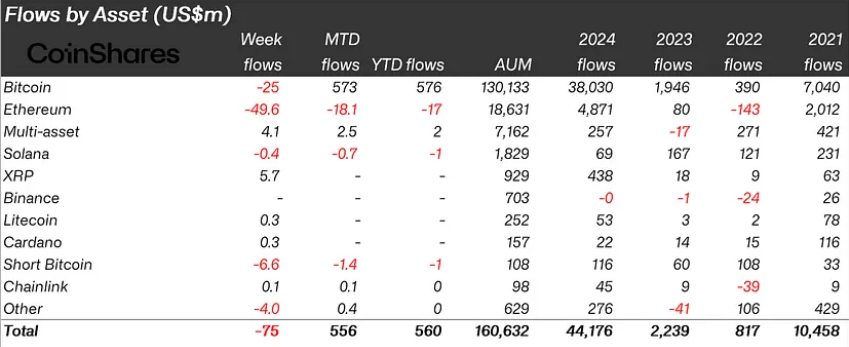

Crypto inflows soared to $585 million in the first three trading days of 2025, marking a strong start to the year. However, the full week, which included the final two trading days of 2024, saw net outflows of $75 million.

This follows a record-breaking 2024, which concluded with global crypto inflows totaling $44.2 billion—nearly four times the previous record of $10.5 billion set in 2021.

Bitcoin’s Dominance and the Role of ETFs

The latest CoinShares report attributes this outcome to ongoing investor transitions to US-based products. Specifically, spot-based ETFs (exchange-traded funds) for Bitcoin and Ethereum continue to draw interest from institutional investors.

“The conclusion of 2024 marked a record $44.2 billion of inflows globally, almost 4x the prior record set in 2021 which saw $10.5 billion inflows. Marked by the entrance of US spot-based ETFs, which saw 100% of the inflows at $44.4 billion,” the report read.

Indeed, Bitcoin led the charge in 2024, attracting $38 billion in inflows. It accounted for up to 29% of total assets under management, an impressive performance driven by Bitcoin ETFs.

These financial instruments have been pivotal in legitimizing Bitcoin as an investment asset, offering institutional and retail investors a regulated and accessible way to gain exposure. As BeInCrypto reported, Bitcoin ETFs are expected to dominate further in 2025, potentially driving even greater inflows as demand for secure, compliant crypto investment vehicles continues to grow.

VanEck CEO Jan van Eck recently urged investors to increase their holdings in Bitcoin and gold through 2025. He highlighted BTC, in particular, as offering valuable protection against inflation, fiscal uncertainty, and global de-dollarization trends.

Altcoins Struggle to Gain Traction

The report also highlights how Ethereum experienced a significant resurgence in late 2024, ending the year with $4.8 billion in inflows. This represents 26% of AuM, marking a 2.4x increase from 2021 and a staggering 60x growth compared to 2023.

Like in the case of Bitcoin, the growing popularity of Ethereum ETFs fueled the growth. As BeInCrypto reported, Ethereum ETFs set a new record in December as institutional interest soared past $2 billion.

Outside of Bitcoin and Ethereum, altcoins saw relatively modest inflows of $813 million in 2024, accounting for just 18% of AuM. This indicates that while interest in alternative digital assets persists, it remains dwarfed by the dominant positions of Bitcoin and Ethereum.

Investors appear to be prioritizing assets with established records of accomplishment and strong infrastructure. To put this in perspective, BlackRock recently said it would focus on Bitcoin and Ethereum, delaying any altcoin ETF plans.

“We’re just at the tip of the iceberg with Bitcoin and especially Ethereum. Just a tiny fraction of our clients own IBIT and ETHA, so that’s what we’re focused on (vs. launching new altcoin ETFs),” Jay Jacobs, the head of BlackRock’s ETF department, reportedly stated.

Nevertheless, the continued rise of crypto ETFs is poised to play a central role in driving the market. Industry experts predict that beyond attracting fresh capital, these financial instruments will also enhance market stability by providing a regulated entry point for institutional investors.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.