Bitcoin Outperforms Ethereum By 44% Since The Merge — Here Are The Key Factors

The cryptocurrency market has been under intense bearish pressure in recent weeks, with several large-cap assets including Bitcoin (BTC) and Ethereum (ETH) struggling to put in a positive shift. The past week was particularly drab for the two largest cryptocurrencies, as they posted double-digit losses in the last seven-day period.

While the BTC price performance has cooled off in the past two quarters of 2024, the flagship cryptocurrency is still outpacing Ethereum in terms of market action. Although some of this can be attributed to ETH’s own underwhelming performance in recent weeks, a blockchain analytics company has offered insight into the dynamics between Bitcoin and Ethereum.

Here’s Why Bitcoin Is Outperforming Ethereum: CryptoQuant

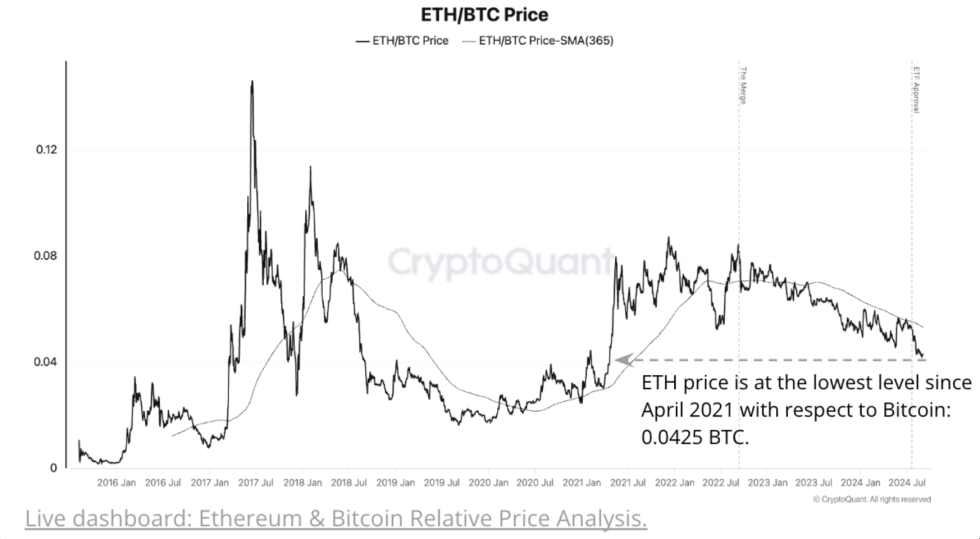

In its latest report, CryptoQuant discussed the performance of Ethereum relative to Bitcoin in recent years. According to the platform’s data, Ethereum has underperformed Bitcoin by 44% since The Merge, an event in 2022 that saw Ethereum (formerly a Proof-of-Work blockchain) transition into a Proof-of-Stake (PoS) network.

As of this writing, data from TradingView shows that the ETH/BTC price stands at around $0.04122, the lowest level since April 2021. ETH’s underwhelming action against BTC has persisted despite the recent launch of spot Ethereum exchange-traded funds (ETFs) in the United States. In fact, the ETH/BTC pair is down by 18% since the approval of the funds.

Source: CryptoQuant

According to CryptoQuant, Ethereum’s sluggish action against Bitcoin can be associated with its relatively weaker network activity. For instance, Ethereum’s network total transaction fees have been on a sustained decline following the Dencun upgrade. Meanwhile, the relative transaction count has fallen to a multi-year low of 11.

Furthermore, the supply dynamics have not been particularly favorable to Ethereum compared to Bitcoin. CryptoQuant highlighted that the total Ether supply has been growing consistently since early April, shortly after the Dencun upgrade. Coincidentally, Bitcoin completed its fourth halving event in April, seeing miners’ rewards slashed from 12.5 BTC to 6.25 BTC.

Moreover, investors have shown a preference for Bitcoin over Ethereum. This fact is supported by the decline in the relative spot trading volume of ETH to BTC, which has dipped from 1.6 (I.e., the former’s spot trading volume was 1.6 times greater than the latter’s) to 0.76 in the past week.

What Next?

Interestingly, CryptoQuant believes that Ethereum could continue to underperform against Bitcoin, especially as it is still above undervaluation territory. According to the analytics firm, ETH/BTC would need to fall at least 50% from its current level to reach the undervaluation zone. As of this writing, the Bitcoin price stands around $53,700 while Ethereum is valued at $2,213, according to CoinGecko data.

ETH struggles against BTC on the daily timeframe | Source: ETHBTC chart from TradingView

Featured image from iStock, chart from TradingView