Bitcoin Funding Rate Turns Negative: Bullish Signal In Disguise?

After plunging over 30% from its all-time high and briefly dropping below $75,000, Bitcoin is showing signs of recovery. The broader crypto market rebounded sharply this week, helped by a 90-day pause on reciprocal tariffs announced by US President Donald Trump for all countries except China, which remains under a 125% tariff. This unexpected shift in trade policy helped ease some macroeconomic pressure and sparked a wave of optimism across global markets.

Bitcoin’s bounce from the lows has renewed confidence among bulls who believe the worst of the correction may be over. While volatility remains high, some on-chain signals are now pointing to a potential bottom formation.

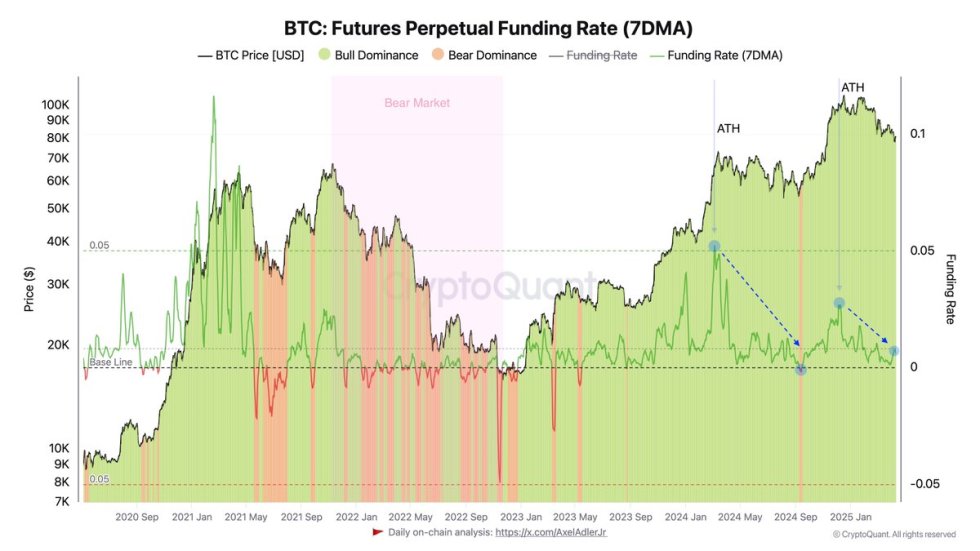

CryptoQuant analyst Axel Adler shared a compelling chart on X, highlighting the Bitcoin Futures Perpetual Funding Rate. Since BTC hit its ATH, the 7-day moving average of the Funding Rate has been trending downward—a key stress signal in bull markets. Adler explains that when this average turns negative, it often reflects rising market tension as traders aggressively open short positions. This shift can lead to funding flipping negative, a condition historically associated with capitulation and, potentially, the start of strong recovery phases.

Bitcoin Faces Crucial Resistance As Sentiment Resets

Bitcoin remains strong after reclaiming the $80,000 level, signaling that the worst of the recent correction may be behind. However, global economic instability continues to weigh heavily on market sentiment. US President Donald Trump’s tariff policies—especially the ongoing trade conflict with China—have added uncertainty to the financial environment, fueling fears of a broader global recession. The recent 90-day pause on reciprocal tariffs has offered some relief, but it’s temporary, and investors remain cautious until a more permanent resolution is reached.

Adler shared essential insights highlighting how the Bitcoin Futures Perpetual Funding Rate has behaved throughout the current cycle. Following the all-time high near $72K, the average Funding Rate steadily declined—mirroring the pattern seen in previous cycles. Just like last time, the metric dipped into negative territory, which historically has marked a reset in market sentiment and preceded a new upward move.

Adler points out that this is less about exact statistics and more about the psychology of market participants. Confidence peaks at highs and collapses during corrections, only to rebuild when traders are forced out and the market “resets.” His chart, featuring blue arrows, shows how these cycles tend to repeat, offering hope that Bitcoin could be primed for another impulse higher.

Price Holds Key Support as Bulls Eye 200-Day Averages

Bitcoin is currently trading at $82,200, sitting just 5% below its crucial 200-day simple moving average (SMA) around $87,100. After reclaiming the $80K level during this week’s relief rally, bulls now face the challenge of defending this ground and pushing higher to regain lost momentum.

To confirm a bullish setup, BTC must hold above the $81K support zone and reclaim the $85K level, which aligns with the 200-day exponential moving average (EMA). These two moving averages are widely seen as long-term trend indicators, and regaining both would mark a significant shift in sentiment.

So far, bulls have been able to absorb selling pressure, but failure to hold above the $81K–$80K zone could trigger renewed panic and send BTC back toward the $75K level—a key psychological and structural support from last week’s low.

Market volatility remains high amid macroeconomic uncertainty, and while Bitcoin shows signs of strength, it’s still vulnerable to downside risk if buyers don’t maintain momentum. The coming days will be critical as traders watch for a breakout above the 200-day EMA or a breakdown toward lower demand.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.