Bitcoin, Ethereum Traders Eye $1.4 Billion Options Expiration

The cryptocurrency market is preparing for short-term volatility, with approximately $1.4 billion worth of Bitcoin and Ethereum options expiring today.

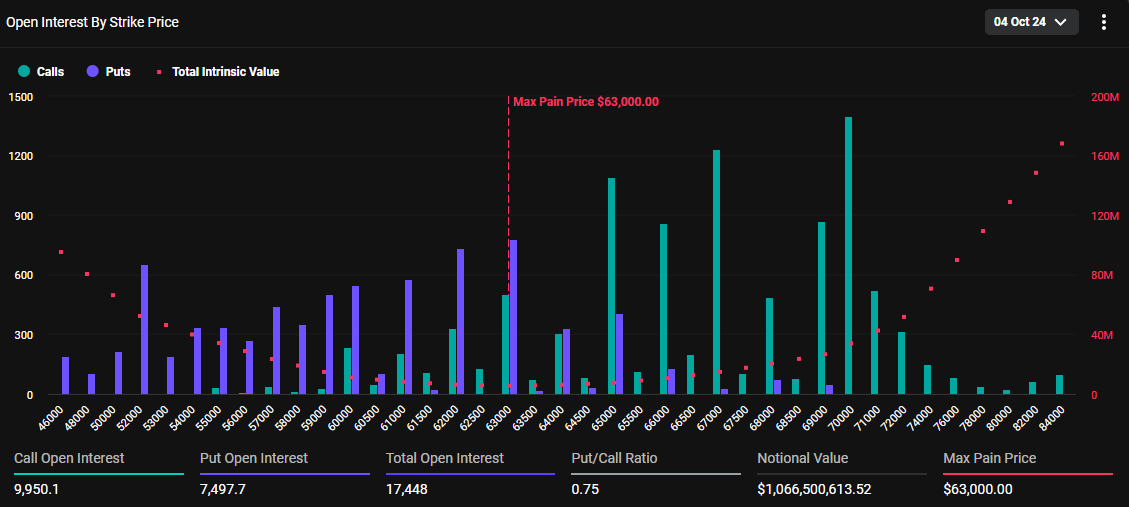

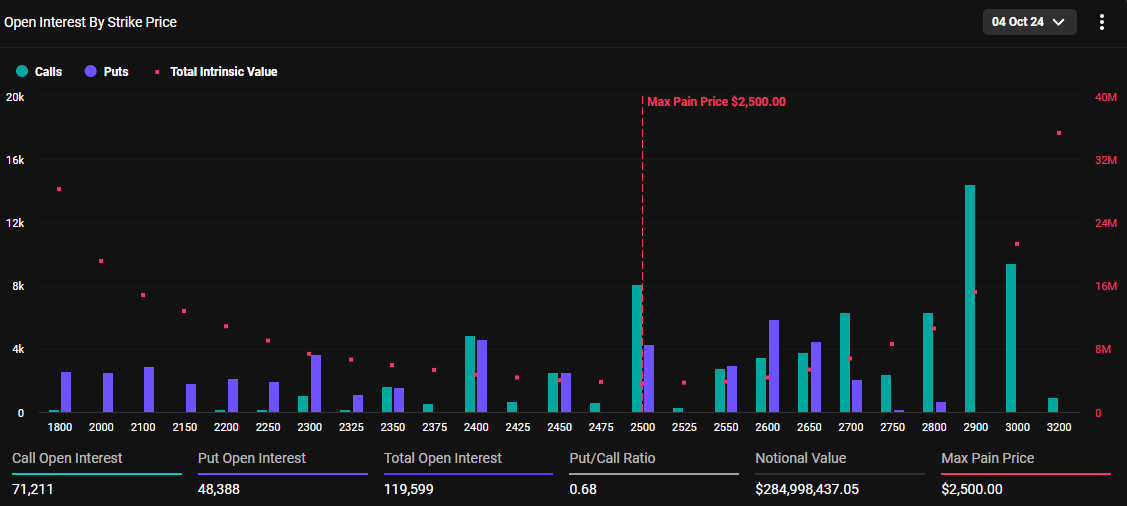

With Bitcoin options totaling $1.066 billion in notional value and Ethereum options accounting for $284.99 million, traders are eyeing the expiration for its potential impact on prices.

Analysts Predict A Market Shakeout Amid Expiring Options

Data on Deribit shows 17,448 Bitcoin options contracts will expire on October 4. The contracts have a put-to-call ratio of 0.75 and a maximum pain point of $63,000.

At the same time, Ethereum’s options market is set to expire with 119,599 contracts. Today’s expiring Ethereum contracts have a put-to-call ratio of 0.68, with a maximum pain point of $2,500.

Read more: An Introduction to Crypto Options Trading

n options trading, the put-to-call ratio serves as a key sentiment indicator by comparing the volume of put options traded to call options. A put-to-call ratio of 0.75 for Bitcoin suggests that more call options are being traded, indicating bullish market sentiment. Similarly, Ethereum’s put-to-call ratio of 0.68 also points to optimism, as more calls than puts are being exchanged.

For those unfamiliar with the concept, a put-to-call ratio below 1 generally signals bullish sentiment, as more investors expect market gains. In contrast, a ratio above 1 often reflects bearish sentiment, signaling concerns about a market decline.

Price Implication Based on BTC and ETH Maximum Pain Points

The current market prices for Bitcoin and Ethereum are below their respective maximum pain points. BTC is trading at $61,209 and ETH at $2,381. This suggests that if the options were to expire at these levels, it would generally signify gains for options holders.

The outcome for options traders can vary significantly depending on the specific strike prices and positions they hold. To accurately assess potential gains or losses at expiration, traders must consider their entire options position, along with current market conditions.

Analysts at Greeks.live suggest that additional market factors could emerge, influencing overall trends and affecting trader decisions. Therefore, comprehensive evaluation is essential before drawing conclusions on options trades.

“Friday’s unemployment rate and non-farm payrolls data, and now the windy A-share market compared to the US stock market is much less favorable. However, the cryptocurrency market is more connected to US stocks, and the only connection between A-shares and crypto might be that many people are out of gold speculating in stocks, knocking down the price of u fiat currency,” they wrote.

The analysts also say crypto markets are entering a shakeout before what has historically been a bullish month. A shakeout is when the otherwise “weak hands” are triggered to sell based on scary market conditions. Geopolitical tensions could aggravate the sell-off, which continues to escalate.

“Today is going to be a big day. Very important job data is coming in the next 7 hours, which will impact the US stock market heavily. We can get a super pump or heavy dump. Israel planning to launch a counterattack on Iran today. Bitcoin needs to hold $60,000 for a bounce but if $60,000 breaks we can see a quick dump to $56,000-$57,000. The best strategy is to hold your positions and not be shaken out,” analyst Ash Crypto advised.

Meanwhile, crypto markets remain subtly optimistic amid bullish US economic data. The Federal Reserve’s decision to cut interest rates amid cooling inflation inspires optimism for riskier assets. Economists expect more rate cuts in 2024, but this remains to be seen. This is as the Fed continues to exercise its dual mandate- to achieve maximum employment and keep prices stable.

Read more: 9 Best Crypto Options Trading Platforms.

Traders are therefore advised to remain cautious, as historically, options expiration often leads to short-term instability in the market. The weekend will also be crucial as it is often characterized by high volatility.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.