Bitcoin ETFs Fuel $15 Billion Crypto Boost

Spot Bitcoin ETF approval in January marked a shift in the crypto industry. Investment bank Architect Partners lauds the product for significantly driving capital inflows in the first half of 2024.

The financial instrument gave institutional players a seat at the table when it delivered BTC to Wall Street. More exposure is expected as Ethereum (ETH) and Solana (SOL) ETFs align.

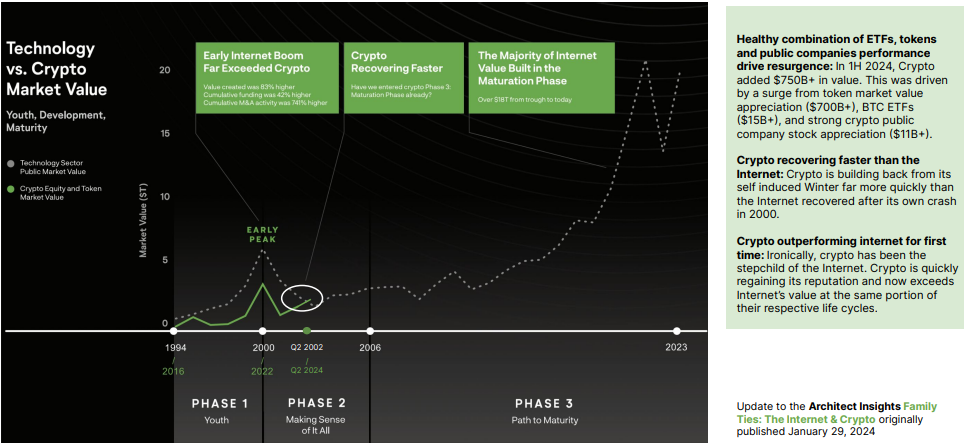

BTC ETFs Among Catalysts for $750 Billion Crypto Surge

Architect Partners’ financial report indicates that Bitcoin Spot ETFs have attracted more than $15 billion to the cryptocurrency market since their launch on January 11. This, combined with more than $700 billion in value growth among crypto tokens and over $11 billion in growth among publicly listed cryptocurrency companies, brings total H1 growth to at least $750 billion year-to-date.

The approval of BTC spot ETFs jump-started the industry after the previous bear market instigated by Terra’s collapse and FTX’s implosion in 2022. According to insights by Architect, crypto’s recovery outpaces that of the internet from its crash in 2000.

Read more: What Is a Bitcoin ETF? All You Need to Know

According to the report, this growth signifies a comeback for the industry, with market confidence and momentum increasing.

“The significant influence of BTC Spot ETFs on the digital assets market is evident from the distribution of trading volume throughout the week. From January to June 2024, weekend trading volume accounted for only 16% of the total, the lowest ever recorded for this period (H1 of a year). This indicates increased activity from traditional finance investors, with trading volume concentrated during Monday to Friday. It is particularly strong during US market hours, decreasing after the US market closes,” Matteo Greco, Research Analyst at Fineqia, told BeInCrypto.

Architect Partners’ report also acknowledged increasing “professionalism, risk management, and ethical behavior.” It highlights the spirit of ‘doing it right’ in the industry, adding that these are the foundational principles of crypto.

Analyst Decries Stagnating BTC ETF Flows

Despite the significant contribution to the industry, BTC ETFs’ capital flows have stagnated lately.

“US Bitcoin ETF flows have mostly stagnated. Not seeing tons of inflows, not seeing tons of outflows. Net inflows since launch sits at very healthy $14.7 billion,” wrote Bloomberg ETF analyst James Seyffart.

Seyffart also noted a drop in BTC ETF trading volumes, highlighting that this metric has not hit $3 billion since mid-May. Fineqia’s analyst, Greco, told BeInCrypto that traditional finance investors concentrate their trading volumes between Monday and Friday, focusing on US market hours.

According to data from investment management company Farside Investors, BTC ETFs experienced total net outflows of $13.7 million on Tuesday. This marked a break from five consecutive trading days of positive flows. Grayscale recorded up to $32.4 million in outflows, effectively topping the day’s negative flows.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach.

The instrumental role of Bitcoin spot EFTs in driving capital into the crypto industry cannot be overlooked. As they account for 2% of the growth in six months, it becomes imaginable how much more could be achieved with more such financial instruments in the market.

Meanwhile, the market awaits a possible Ethereum (ETH) spot ETF launch within the month. The countdown is also on for a prospective Solana (SOL) ETF following VanEck’s move to pioneer the application in the US.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.