Bitcoin Cash hash rate hits yearly peak as Phoenix dominates 90% of the network

Bitcoin Cash’s hash rate soared to a yearly high this week after an unknown miner captured around 90% of its blocks within two days.

This surge comes as the network’s native BCH token hit a four-month low following a broader market crash and the defunct Mt. Gox BCH repayment plans.

Phoenix mines 90% of BCH blocks

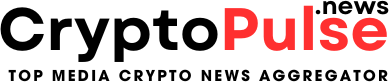

According to 2miners data, the Bitcoin Cash network saw a massive hash rate surge between July 2 and July 4, rising from 3.6 EH/s to a yearly high of 9.4 EH/s before declining back to the weekly average of 3.3 EH/s as of press time.

The hash rate is a critical measure of a blockchain network’s health. It measures the computational power used to mine and process transactions. A higher hash rate means a more secure network, requiring more computational power to alter the blockchain and making it more resistant to attacks.

Conversely, a lower hash rate indicates less computational power for mining and processing transactions, reducing the network’s overall security.

So, while BCH’s dramatic jump in hash rate excited the crypto community, it also sparked speculation about its causes and implications for the network.

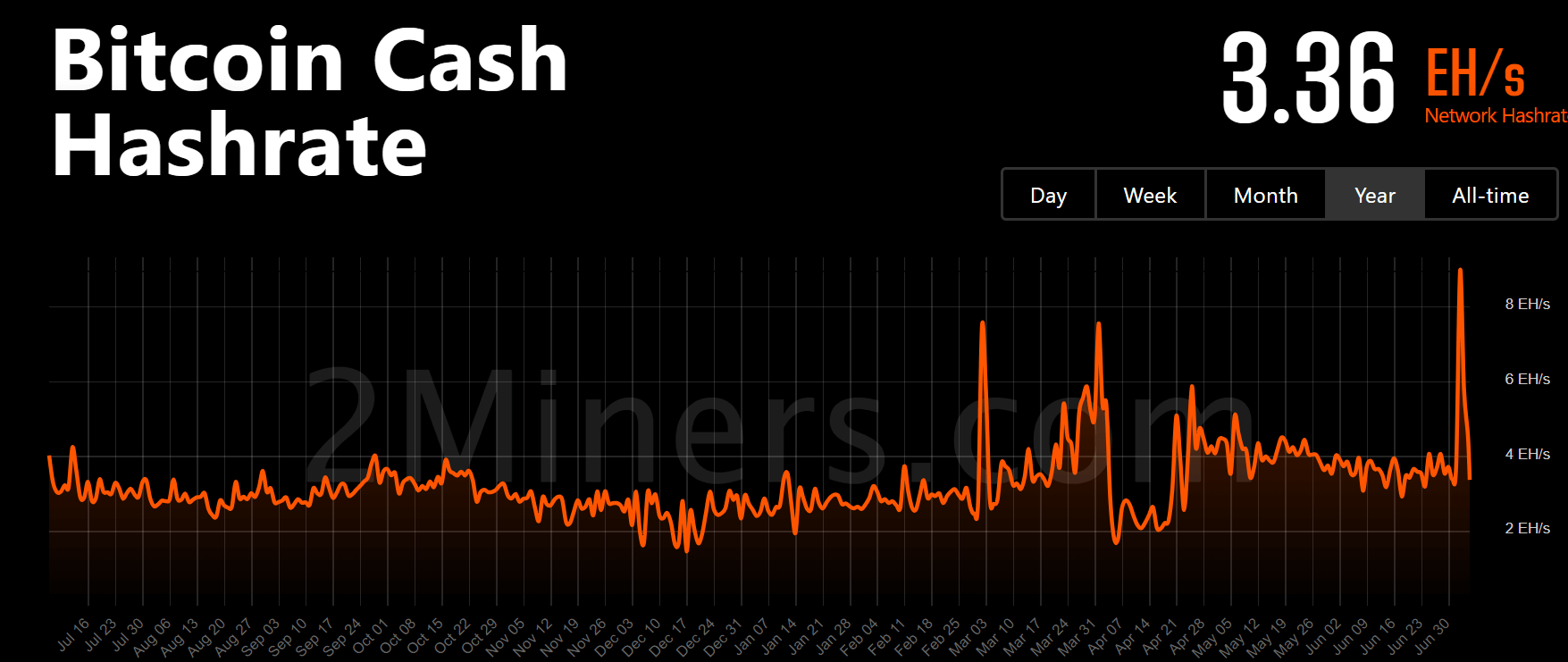

The Bitcoin Cash Podcast attributed the surge to a new miner named “Phoenix, ” which captured most of the new BCH supplies. Data shows this miner produced about 90% of the blocks during those two days, though its dominance has fallen to 29% at press time.

Parker Merritt, a researcher at CoinMetrics, supported this view. He suggested the miner was linked to the Phoenix Group, an Abu Dhabi-listed Bitcoin mining company that recently launched a mining pool service for BTC and BCH networks.

Further, Merritt noted that Phoenix’s actions might be an attempt to highlight the “risks of mining centralization.”

Price declines to 4-month low

Bitcoin Cash mining issues surfaced when the network’s native BCH token plunged to a four-month low of $305.

Market observers attributed the decline to the broader market decline that saw major digital assets like Bitcoin fall by around 7% in the past day to under $55,000. At the same time, Ethereum also lost the $3,000 mark during the reporting period.

Additionally, Merrit pointed out that BCH’s price might face heavy selling activity as Phoenix might not HODL their earnings.