Bitcoin Bullish Q4 Narrative Fueled By FTX Repayment Developments: Report

According to a report by crypto research firm K33 Research, Bitcoin (BTC) price could benefit from the latest developments in the FTX bankruptcy saga.

FTX Creditor Payouts Could Be Bullish For Bitcoin

Analysts at K33 suggest that recent developments in the FTX estate creditor repayment process could help the leading digital asset maintain its bullish price momentum in Q4 2024.

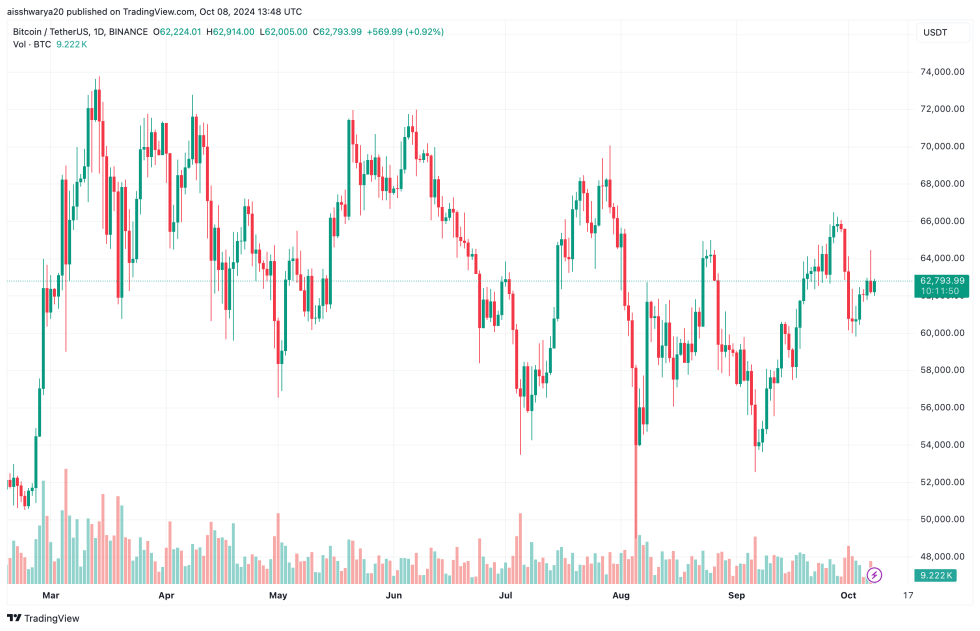

Last week, escalating geopolitical tensions in the Middle East and stronger-than-expected US jobs data led to a slight pullback in Bitcoin. The flagship cryptocurrency dropped from $65,920 on September 28 to $60,200 on October 3, before recouping some losses over the weekend.

On October 7, Judge John Dorsey in the US Bankruptcy Court for the District of Delaware, approved the highly-anticipated FTX reorganization plan, which seeks to initiate creditor repayments nearly two years after the fall of the Bahamas-based crypto exchange.

Notably, nearly 94% of creditors in the “dotcom customer entitlement claims” class voted in favor of the reorganization plan. The plan’s only major criticism was Sunil Kavuri – a representative of the largest FTX creditor group.

Kavuri called for the estate to pay out digital assets in kind, rather than their corresponding dollar value when FTX filed for bankruptcy in November 2022.

In the report, K33 analysts Vetle Lunde and David Zimmerman expect creditor payouts to start rolling out in the latter half of Q4 2024 and continue into early Q1 2025. These payouts will occur within a 60-day window of the court’s effective date. While the date is unknown, it is expected to be sometime in mid-November. The report notes:

Debtors will have 60 days to repay individual customers with claims under $50,000, representing approximately $1.2 billion worth of assets. Larger creditors (entitlement class) are expected to receive their $9 billion payouts in February 2025.

Bulls Monitor The Funds Entering Crypto Market

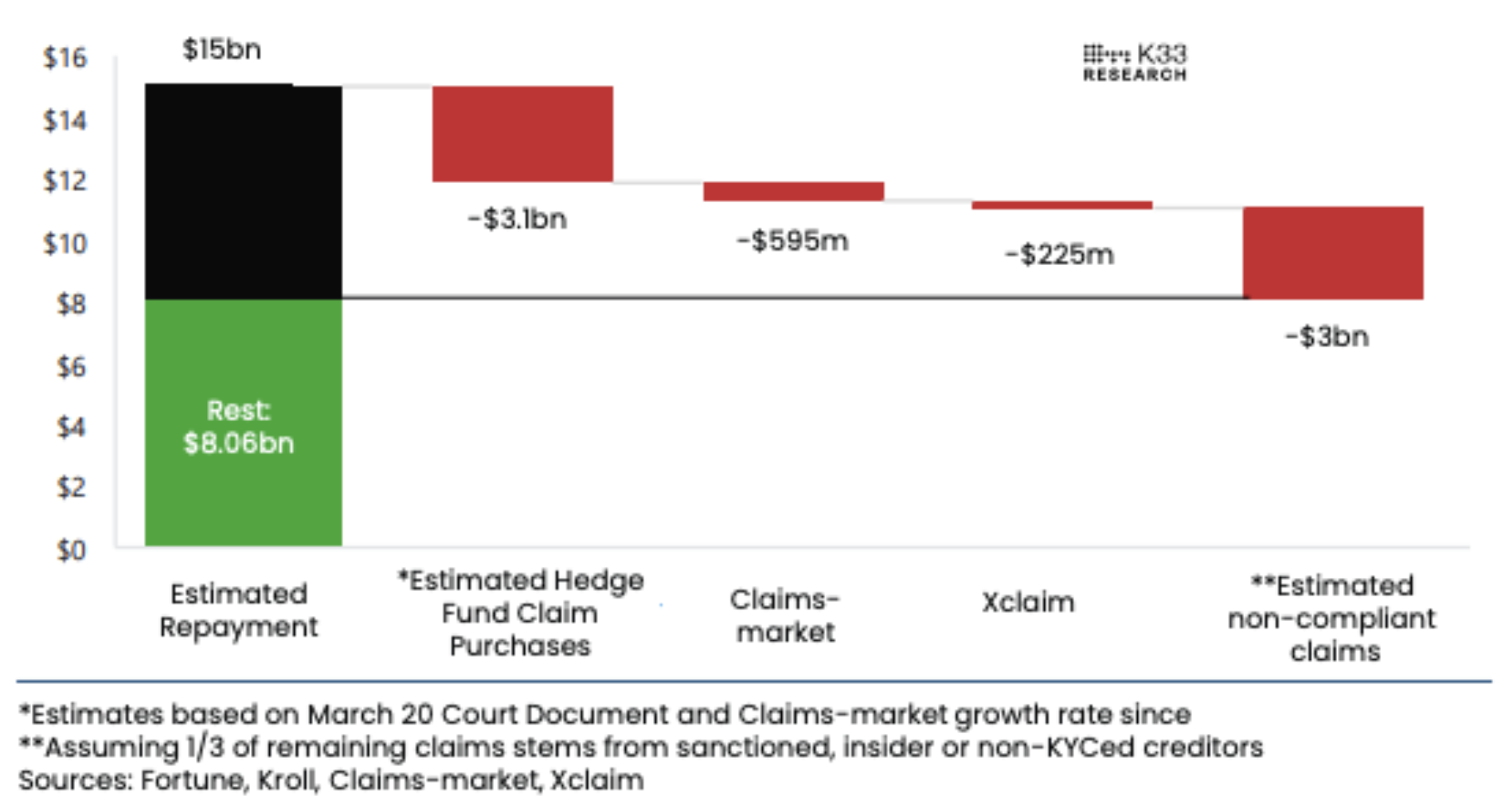

Bitcoin bulls will likely focus on the amount of payout funds that can potentially re-enter the crypto market. Notably, a considerable chunk of digital assets have already been converted to fiat, reducing the potential sell-side pressure from the estate plan.

The analysts posit that of the $14.4 billion to $16.3 billion in claims, approximately 25% – or $3.9 billion – has already been purchased by credit funds and is unlikely to re-enter the market.

Additionally, 33% of the remaining claims belong to a subgroup of sanctioned nations, insiders, and entities without KYC verification. These assets are unlikely to be claimed.

After accounting for these factors, 20% to 40% – or roughly $2.4 billion – of the remaining $8 billion could return to the markets since “FTX’s trader base consisted of crypto-native aggressive risk takers.”

The report further emphasizes that this capital will likely enter the markets in multiple waves throughout 2025, having a relatively muted impact on the overall crypto market. Bitcoin trades at $62,793 at press time, down 1.1% in the last 24 hours.

Featured Image from Unsplash.com, Charts from K33 and TradingView.com