Big Players Actively Accumulate Bitcoin Amid Market Turmoil – On-Chain Metrics

Bitcoin is currently undergoing one of the most aggressive corrections ever seen during a bull market — not just in terms of price but also in investor sentiment. While BTC remains technically in a long-term uptrend, the emotional toll on the market tells a different story. Panic, confusion, and fear dominate the landscape as investors question whether this bull cycle is truly still intact. The steep drop in price, coupled with relentless volatility, has rattled even the most seasoned traders.

Macroeconomic tensions continue to weigh heavily on global markets. Escalating trade disputes, rising inflationary pressures, and growing concerns about a full-blown global recession are sending shockwaves across both traditional and digital asset classes. For Bitcoin, often considered a hedge against fiat instability, these headwinds have not translated into strength — at least, not yet.

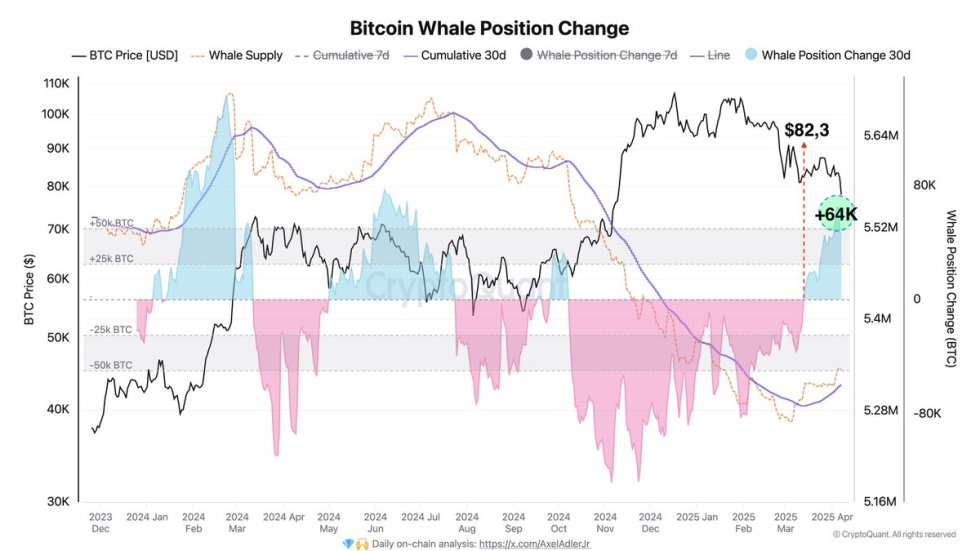

However, beneath the surface of this chaos, something else is happening. According to data from CryptoQuant, major players are actively accumulating Bitcoin despite the ongoing selloff. Large wallets continue to grow, signaling confidence from institutions and high-net-worth individuals. While short-term pain remains, this accumulation trend could be laying the foundation for a powerful rebound once the dust settles and market stability returns.

Bitcoin Holds Near $76K as Whales Buy Amid Market Turmoil

Bitcoin is trading around $76,000 after enduring several days of intense selling pressure and market volatility. Since hitting its all-time high earlier this year, BTC has dropped over 30%, with no immediate signs of a strong recovery. Analysts continue to warn of further downside as global tensions mount and U.S. President Donald Trump’s aggressive policy decisions — particularly new tariffs — create additional uncertainty in financial markets.

The broader macroeconomic environment remains fragile. Fears of a global recession, ongoing inflation concerns, and tightening liquidity conditions are dragging on investor sentiment. Bitcoin, often viewed as a risk asset, has not been immune to these pressures, as panic selling and defensive positioning continue to define the landscape.

Yet, despite the grim outlook, there are signs of strategic accumulation behind the scenes. Crypto analyst Axel Adler shared new data from CryptoQuant showing a rise in the Bitcoin Whale Position Change indicator. This metric tracks net accumulation or distribution by large holders, and recent readings suggest that whales are quietly increasing their positions.

This behavior signals growing confidence from major players, even as retail sentiment deteriorates. While a swift rebound might not be on the immediate horizon, the ongoing accumulation by deep-pocketed investors could lay the groundwork for Bitcoin’s next major move once macro conditions begin to stabilize.

BTC Price Holds at $77,200 But Faces Critical Resistance Ahead

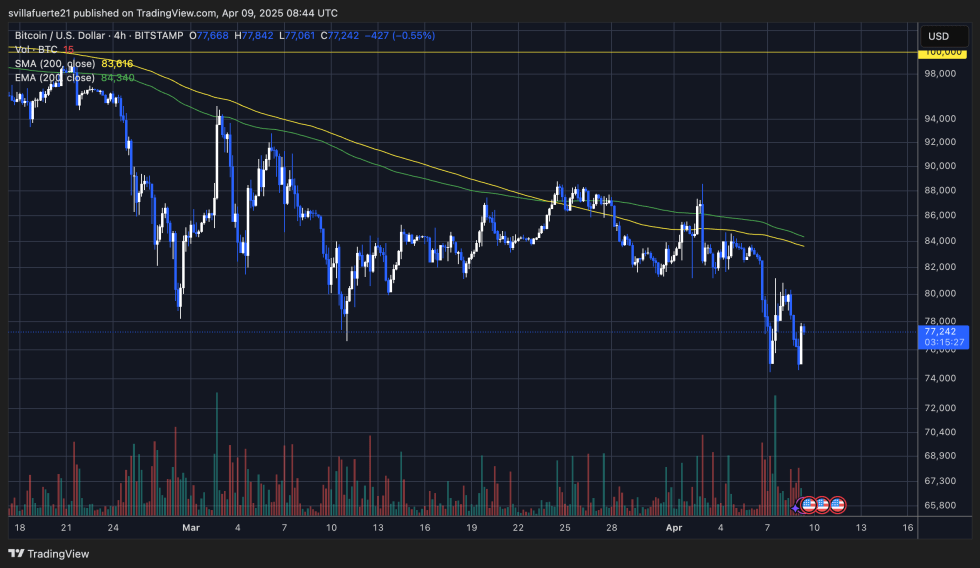

Bitcoin is currently trading at $77,200 after establishing a short-term support zone around the $75,000 level on the 4-hour chart. This area has become a critical line in the sand for bulls, as it has helped prevent further downside in the face of ongoing market volatility and macroeconomic uncertainty.

However, Bitcoin’s price action remains fragile. To regain bullish momentum and shift sentiment, BTC must reclaim the $85,000 level — which aligns with both the 4-hour 200-day Moving Average (MA) and Exponential Moving Average (EMA). Breaking above this zone would mark a key technical recovery and potentially trigger a rally back toward $90,000 territory.

Until then, the $81,000 level serves as an immediate resistance that bulls need to overcome. Failing to reclaim this level soon, while simultaneously losing grip on the $75,000 support, could trigger a more severe correction. A breakdown below $75,000 would open the door to a sharp move toward $70,000 or even lower, confirming broader bearish momentum.

For now, Bitcoin remains at a crucial crossroads. Traders are watching closely to see if bulls can reclaim key resistance levels — or if the next leg down is just around the corner.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.