Altcoin Season Prediction: Bitcoin Weakness Fuels Speculation

Analysts are focusing on altcoins as Bitcoin (BTC) experiences a price decline, with hopes of a potential altseason. This phase, which often follows Bitcoin halvings, has been anticipated since the fourth Bitcoin halving in April.

An altcoin season refers to a period where altcoins outperform Bitcoin and Ethereum (ETH), offering better investment returns.

Analysts Say It’s Altcoin Accumulation Phase

Mags, a prominent crypto analyst, points out that altcoins are trading at 60% to 80% of their previous highs. He highlights that the Total2, which tracks the market cap of the top-125 cryptocurrencies excluding Bitcoin, is holding above an ascending trendline.

If this support holds firm, Mags suggests it could signal the beginning of the “biggest altcoin season of all time.” When Total2 stays above a trendline, it indicates positive momentum and a bullish trend for altcoins.

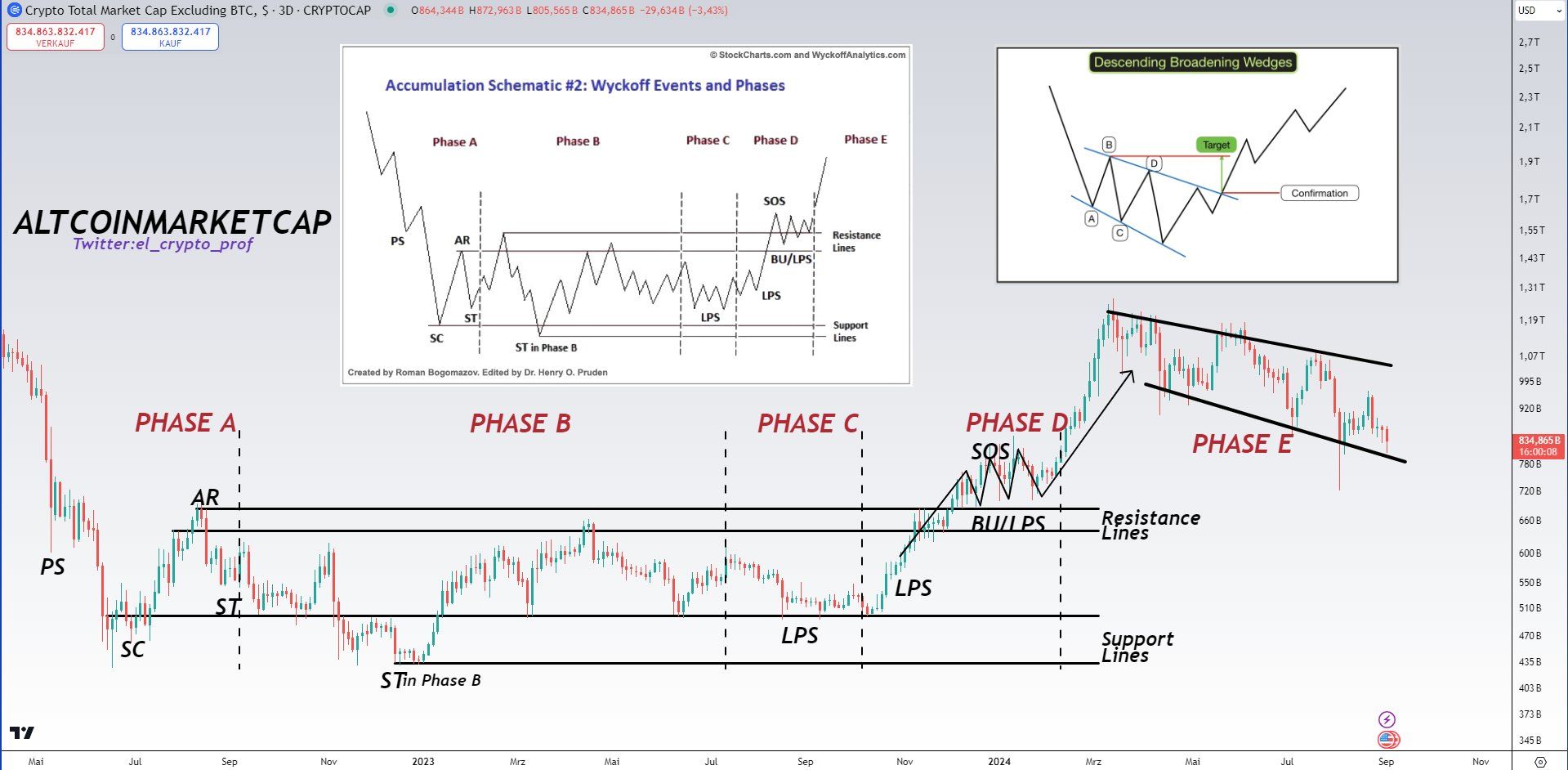

Another analyst, Mustache, notes that altcoins have maintained a perfect Wyckoff accumulation pattern for several years. He suggests that altcoins are now consolidating before their next upward move, as price action tightens within a descending broadening wedge pattern.

Mustache highlights that the activity is occurring on higher timeframes, even though the lower timeframes currently indicate a weaker market outlook.

Read more: 10 Best Altcoin Exchanges In 2024

A Wyckoff Accumulation Pattern is a technical chart formation used by analysts to identify potential buying opportunities after a prolonged downtrend. During this phase, the asset’s price consolidates within a range as buyers and sellers vie for control.

The pattern suggests that institutional investors (smart money) accumulate the asset at lower prices, while selling pressure weakens. This forms a base for a potential price reversal, signaling that the asset could soon move upward as demand increases and selling subsides.

Current Bear Market Corrects Post-Halving Abnormality

CryptoEstigma, another analyst on X, says the ongoing bear market is a correction following an atypical event after the fourth Bitcoin halving. Unlike previous cycles, altcoins rallied earlier than usual this time. Historically, alt seasons tend to start toward the end of the halving year, but the early rally disrupted this trend, leading to the ongoing market correction.

“The halving effect had not yet occurred and yet the altcoins had multiplied their value by too many Xs,” CryptoEstigma explained.

Meanwhile, crypto markets are grappling with US economic events, such as Federal Reserve decisions, geopolitical tensions, and recession fears, contributing to heightened volatility. While some analysts foresee an altcoin season, others, like Duo Nine, warn against over-investing in altcoins, citing rising Bitcoin dominance and negative Ethereum ETF flows.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

Further, another group of analysts remains in the grey area, preparing for any eventuality by rebalancing their portfolio and positioning themselves for optimal returns. Nevertheless, there is a side that says even if it does come, it may fail to be as rigorous as that of 2017 and 2020.

“Anyone can launch an altcoin now, which has completely diluted the market. If altseason ever happens again, it will be a fraction of the gains from 17 or 20. Meanwhile, Bitcoin keeps gaining market share,” said venture capitalist Jeff Kirdeikis.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.