Bitcoin Transaction Volume Reveals Retail Investors Are Coming – Details

Bitcoin has entered a brief consolidation phase after reaching new all-time highs last week, following an aggressive price surge that captured the market’s attention. The rally came on the heels of two significant events: former president Donald Trump’s victory in the U.S. election and the Federal Reserve’s decision to cut interest rates. These developments fueled optimism across markets, pushing BTC into uncharted territory.

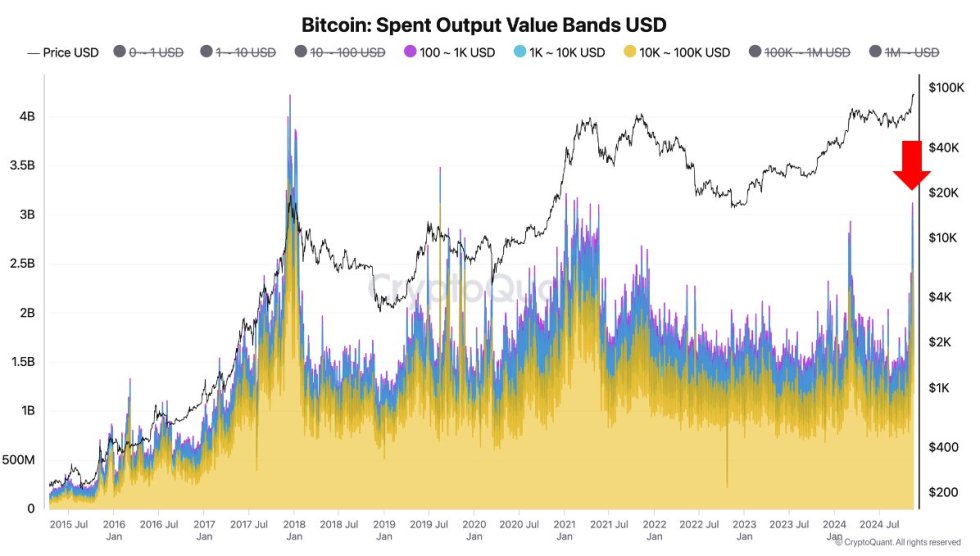

Key data from CryptoQuant Founder Ki Young Ju provides further insight into this rally’s underlying drivers. According to Ju, retail investors are returning to the market in droves, a strong indicator that Bitcoin’s recent surge is not a short-lived event but the start of a more sustained bull run.

Historically, increased retail activity has coincided with explosive growth phases for BTC, adding weight to the narrative of further upside.

Analysts point to robust demand and favorable macroeconomic conditions supporting continued bullish momentum. While the price may face short-term corrections, the influx of retail investors suggests a strong foundation for the next phase of this rally. Bitcoin’s resilience and rising popularity reinforce its position as a leader in the evolving financial landscape.

Bitcoin Party Has Just Started

Bitcoin has confirmed a bullish rally after breaking all-time highs multiple times over the past two weeks. This recent surge has many investors believing this is just the beginning of a larger upward movement, with some predicting that BTC could reach the $100,000 mark in the coming weeks.

The rally has been marked by strong momentum, consistently setting new price levels and demonstrating resilience despite potential market corrections.

Data from CryptoQuant CEO Ki Young Ju suggests that retail investors are starting to play a more prominent role in this rally. According to Ju, Bitcoin’s transaction volume under $100K has reached a three-year high, indicating retail participation is increasing. Retail investors have historically been a key driver of Bitcoin’s price surges, and when they enter the market, it often leads to massive gains for BTC and the broader crypto market.

This increase in retail activity could signal the start of another euphoric phase for BTC, similar to what was seen during past bull markets. As retail investors begin to show interest, the demand for BTC could surge, pushing the price higher and fueling the market’s overall bullish sentiment.

With Bitcoin breaking new highs and retail interest increasing, the stage is set for a potentially explosive run toward $100,000. If the current momentum continues, it could usher in a new growth phase for BTC, bringing fresh opportunities and further solidifying its position as the leading digital asset.

BTC Testing Crucial Supply

Bitcoin is pushing above $90,000, reaching a price of $91,777 after several days of consolidation just below its all-time high (ATH). This upward movement suggests that BTC is primed for a continuation, fueled by rising demand and an influx of retail investors entering the market.

As the price tests key supply levels near the ATH, it faces crucial support at the $87,000 mark, a significant demand level that could propel BTC toward the psychological $100,000 level. Holding this level is vital for maintaining upward momentum and confirming the bullish outlook.

If BTC loses support at $87,000, it risks prolonging the current consolidation phase or even triggering a correction to lower demand levels, potentially halting further price advances.

The coming days will be critical as the market evaluates BTC’s ability to hold above this key level. A break above $95,000 and a push toward $100,000 could materialize if successful, solidifying the bullish trend. However, failure to maintain support could lead to heightened volatility and a deeper retrace, creating uncertainty for investors watching the market closely.

Featured image from Dall-E, chart from TradingView