Top 4 Altcoins to Watch

As Bitcoin continues to show strength, analysts are diverting their attention to altcoins with hot narratives — GameFi, AI, DePIN, and RWA.

Hence, renowned crypto analyst Miles Deutscher unveiled his top four altcoin picks, naming potential high-yield investments riding on these narratives.

SuperVerse (SUPER): Riding the Gaming Wave

The analyst ranks SUPER, a gaming token, at the top of his list, calling it a “meme” due to its strong community support. However, he stressed that SUPER also offers real utility within the gaming economy. He noted that the combination of cultural appeal and practical use is often key to determining which crypto projects succeed.

SUPER has seen immense growth amid the rise of play-to-earn models and the integration of NFTs (non-fungible tokens). The token has surged 70% since Deutscher’s September 21 call, and he believes it has even more room for growth. He attributes the success to the powerful influence of belief and community support.

For gaming investors, Deutscher sees SUPER as a key altcoin to stack, with future gains expected as the market recognizes its potential.

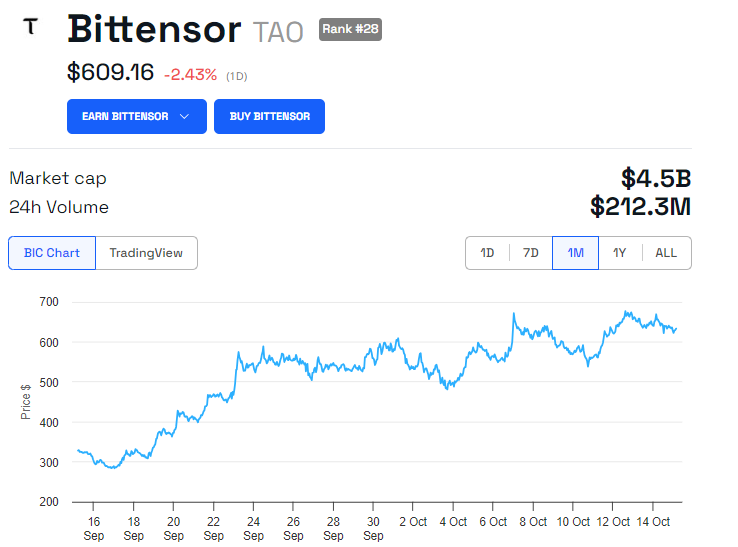

Bittensor (TAO): Leading the AI Narrative

TAO is another top pick, benefiting from the ongoing AI narrative. AI’s potential to revolutionize multiple industries, along with crypto’s integration into that revolution, makes Bittensor a critical player in the space.

Deutscher notes that TAO has garnered attention both within and outside the crypto space, even receiving a boost from Elon Musk’s mention on X (formerly Twitter). He highlights TAO’s long-term potential due to its central role in AI infrastructure.

According to the analyst, TAO has consistently provided buying opportunities through minor pullbacks, making it a solid choice for investors eyeing the AI sector.

While the token has already seen significant gains, Deutscher advises buying during dips. At the time of writing, TAO is trading at $609.16.

Mantra (OM): Betting on RWA

Mantra positions itself at the intersection of DeFi and real-world assets (RWA). Deutscher bets on its unique position in the RWA space, which, in his opinion, makes it an attractive long-term hold. The niche promises immense growth potential in the coming years.

RWA tokenization — the process of converting physical assets like real estate, bonds, and commodities into digital tokens on the blockchain — is gaining momentum. High-profile figures, including BlackRock’s Larry Fink, continue to emphasize its growing significance.

“We have the technology to tokenize today. If you have a tokenized security and identity, the moment you buy or sell an instrument on a general ledger, that is all created together. You want to talk about issues around money laundering. This eliminates all corruption by having a tokenized system,” Fink explained.

Mantra’s ability to ride this wave, coupled with its current technical setup, makes it a strong contender for long-term growth. Mantra’s OM token price has already delivered impressive returns, with a 2X to 3X increase since Deutscher’s initial recommendation. Despite its recent price surge, Deutscher expects further growth and suggests buying during potential retracements.

Render (RNDR): A DePIN Player with Technical Strength

RNDR rounds out the analyst’s top four picks. Deutscher picks Render as a top decentralized physical infrastructure network (DePIN) play. Render provides decentralized GPU computing power, which has a variety of use cases, especially in AI and high-performance computing.

While there are other promising projects in the sector, including Aethir (ATH), Deutscher finds Render particularly appealing for both short-term trading and long-term holding. Its current price action and technical setup indicate that it could see significant gains soon, making it a strong altcoin to watch.

Miles Deutscher’s top four altcoin picks—SUPER, TAO, Render, and Mantra—represent broader crypto trends capable of dominating the market. Each of these tokens stands at the forefront of narratives shaping the future of crypto.

Investors seeking opportunities in the altcoin space may consider monitoring these four projects, balancing short-term technical analysis with long-term market trends. However, traders must always conduct their own research.