Bitcoin Miners Navigate Capitulation Amid Shrinking Profit Margins

Bitcoin miners are currently facing significant “capitulation,” pushing them to innovate for additional revenues.

Bitcoin miner capitulation occurs when miners are forced to shut down due to unprofitability or unsustainable operating costs. This can happen when the cost of mining (including electricity, hardware, and operational expenses) exceeds the revenue generated from mining the bellwether asset.

Bitcoin Miners Face Economic Pressures Amid Capitulation

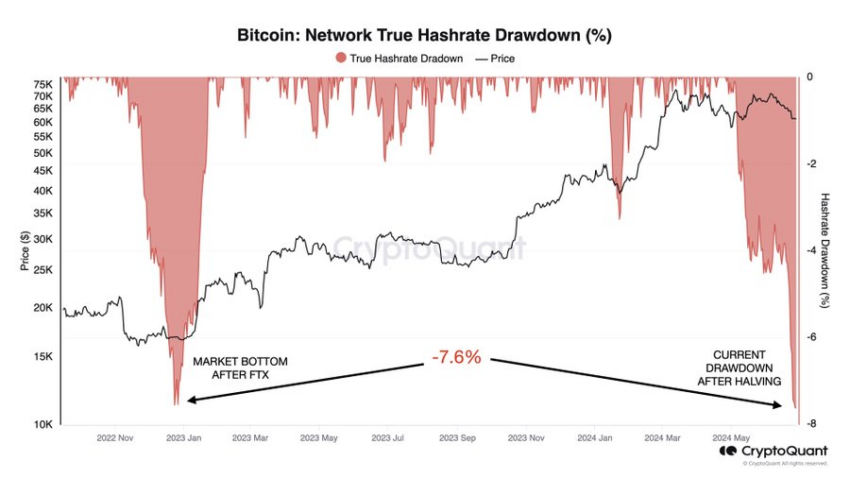

Data from CryptoQuant shows a 7.6% drop in Bitcoin mining hashrate this month, now resembling levels last seen during the FTX exchange collapse in December 2022. Unlike that period, today’s decline follows Bitcoin’s recent halving, cutting miner rewards to 3.125 BTC.

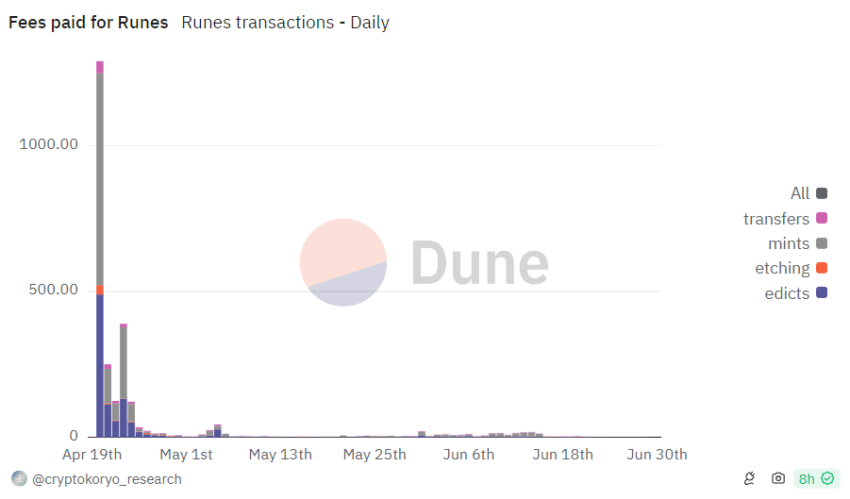

Miners are also grappling with reduced revenues from alternative sources as network activity diminishes. Initially, they benefitted from high fees during the Bitcoin-based Runes protocol frenzy post-halving. However, earnings have sharply declined as network activity slowed.

As of June 29, daily Rune transactions have plummeted from a peak of over 753,000 on April 23 to 21,861, marking a drastic 90% decrease. Consequently, total miners’ earnings from Rune transactions have fallen below 2 BTC in the past week, down from a peak of over 1000 BTC on April 20.

Read more: Making Passive Income From Crypto Mining: How to Get Started

Facing these economic pressures, miners are powering down their machines and have intensified selling activities this month. Last week, BeInCrypto reported that miners had offloaded approximately 30,000 BTC, valued at $2 billion.

To further diversify revenue streams, miners are increasingly turning to artificial intelligence (AI) and other Proof-of-Work (PoW) assets. Companies like Core Scientific and Hut 8 have secured significant funding for AI expansion. Matthew Sigel, VanEck’s head of digital research, reported that Morgan Stanley’s Head of Sustainability Research, Stephen Byrd, explained that these moves show that miners see potential profitability in AI ventures amid evolving market dynamics.

“I do respect the idea that Bitcoin mining could become more profitable. There’s a game theory here…the more people who exit Bitcoin mining and become data centers, the more attractive it is for those who remain,” Byrd reportedly said.

Read more: Top Cryptocurrency Mining Pools To Join 2024

On the other hand, Marathon Digital, the largest BTC mining company, has announced its entry into mining Kaspa, a PoW project. The firm stated that it has mined 93 million KAS, valued at approximately $15 million as of June 25.